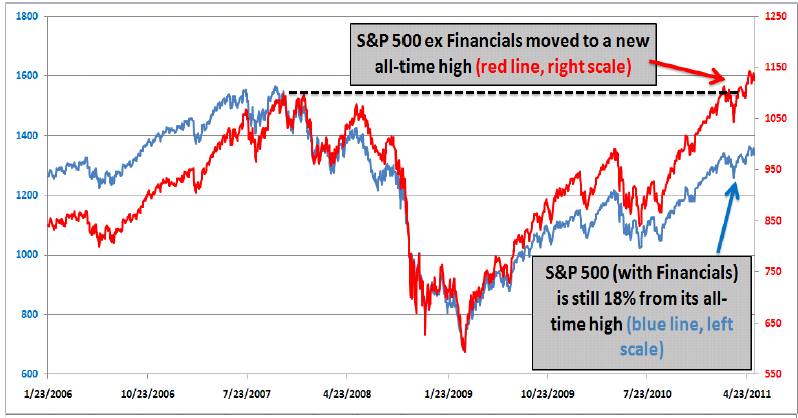

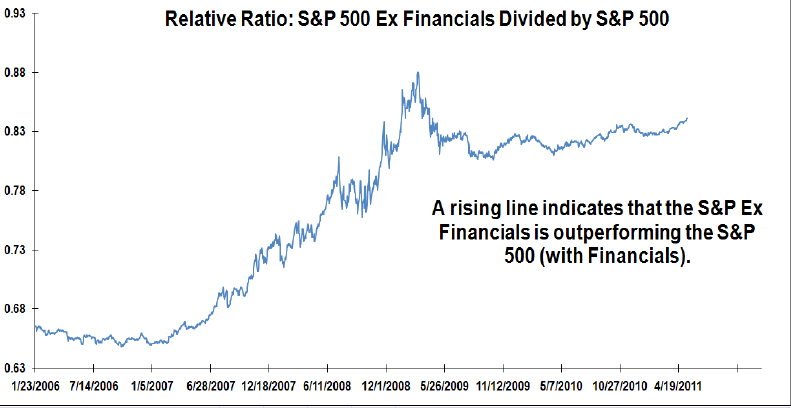

Master technician John Roque of WJB Capital put out a fascinating chart this week, looking at what a drag the financial sector has been on the overall market. John also notes how poorly Goldman Sachs is trading; only AIG (-37% ytd) and HCBK (-27% ytd) have worse year-to-date performance among S&P financials.

If you could magically back out the financials, the market would be at an all time high:

>

What's been said:

Discussions found on the web: