Société Générale has a very interesting piece out this morning looking at the notion of economic surprises and a double-dip scenario:

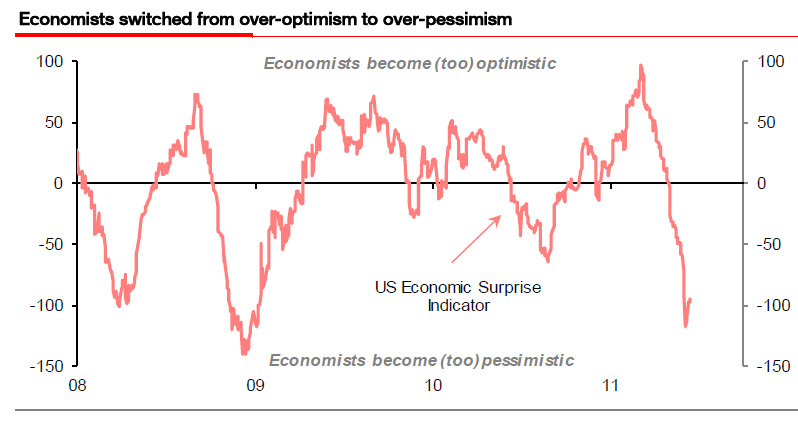

“The economic surprise indicator has returned to very low levels, indicating that a lot of negative surprises are now discounted. We don’t believe that the indicator will remain low for long as the drop is mainly due to a combination of several exceptional factors in H1 2011, i.e. the earthquake and nuclear threat in Japan, the hurricane in the US and the oil price spike owing to turmoil in the ME/NA region.”

The economic surprise indicator is SocGen’s proprietary measure of deviation of economic data surprises, calculated as the difference between figures released and figures expected by consensus.

>

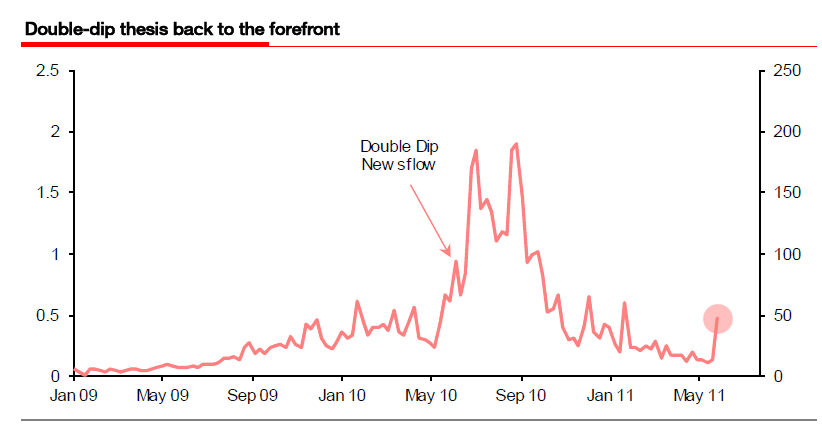

Number of news articles related to double dip

click for larger chart

Source Bloomberg, Citigroup, SG Cross Asset Research

Their proprietary newsflow indicator suggests that doubledip scenarios have come back to the forefront of the news, supporting the bond market but penalising cyclical assets.

>

Newsflow Analysis

Source: Dow Jones, SG Newsflow Watch, SG Cross Asset

>

See also: Citigroup Economic Surprise Index, Trader’s Narrative

Source:

Don’t believe the doom merchants

We don’t ascribe to the double-dip scenario: markets remain liquidity-driven

Société Générale Cross Asset Research, Q3 2011

http://www.sgcib.com/solutions/global-markets/cross-asset-research/cross-asset-research

What's been said:

Discussions found on the web: