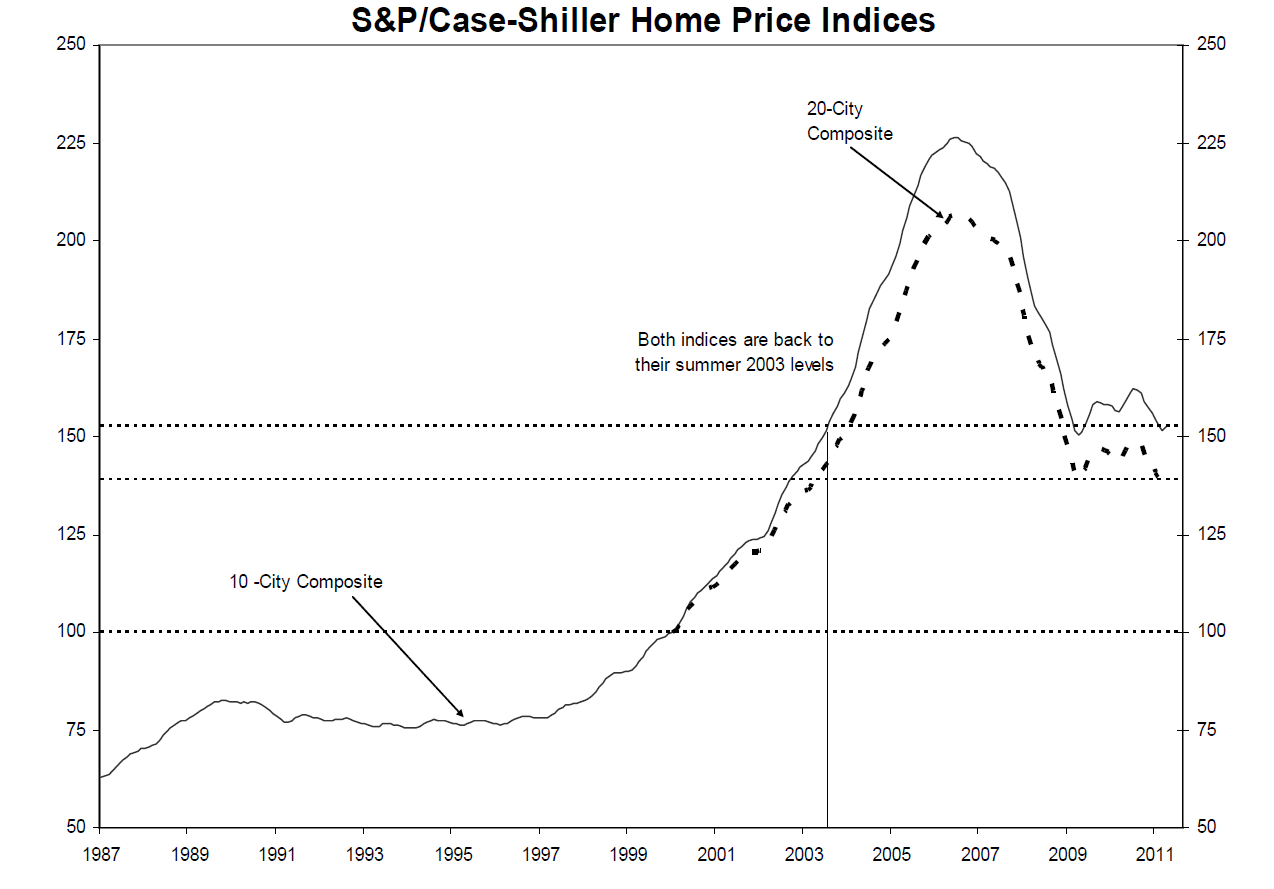

Case Shiller Home Price Indices showed a monthly increase in prices for the first time in eight months. This was for the month of April, which is usually the beginning of the best six months of the year for home sales. (See this chart of Non Seasonally adjusted Existing Home Sales)

Davied Blitzer of S&P Indices noted “However, the seasonally adjusted numbers show that much of the improvement reflects the beginning of the Spring-Summer home buying season. It is much too early to tell if this is a turning point or simply due to some warmer weather”

~~~

What's been said:

Discussions found on the web: