While Baghdad Bob Ben Bernanke says that everything is fine, China’s Dagong credit rating agency says the U.S has already defaulted. As AFP reports:

“‘In our opinion, the United States has already been defaulting….Washington had already defaulted on its loans by allowing the dollar to weaken against other currencies – eroding the wealth of creditors including China, Mr Guan said.”

This follows on the heels of German credit rating agency Feri’s downgrade of U.S. bonds a full notch – from AAA to AA – saying:

“The U.S. government has fought the effects of the financial market crisis primarily by an increase in government debt. We do not see that there is sufficient attention being paid to other measures, “said Dr. Tobias Schmidt, CEO of Feri Rating & Research AG. “Our rating system shows a deterioration in economic health, so the downgrading of the credit ratings of U.S. is warranted.”

Which – in turn – follows American credit rating giant Standard & Poors’ warnings about a potential future downgrade to U.S. credit.

While the deficit hawks will take both announcements of proof that they were right, and the deficit doves will say that people are too concerned with debt and that we need more stimulus, neither are looking at the facts.

The government’s entire approach has been to prop up the lenders by giving trillions to the giant, insolvent banks.

But as economist Steve Keen proved years ago, giving money to the debtors is would have stimulated the economy much more than giving it to the lenders.

Indeed, top experts agree that too much inequality leads to economic crashes. Basically, if one poker player gets all of the chips, the game ends … and the government’s policies have caused more inequality than we’ve had in this country since 1917 — well before the Great Depression.

As Robert Reich put it yesterday

The problem isn’t on the supply side. It’s on the demand side. Businesses are reluctant to spend more and create more jobs because there aren’t enough consumers out there able and willing to buy what businesses have to sell.

***

Consumers can’t and won’t buy more.

***

How to get jobs back, then? By reigniting demand. Put more money in consumers’ pockets and help them renegotiate their mortgage loans.

***

But we’re not hearing any of these sorts of demand-side solutions from the White House.

(Before you jump to the conclusion that this is a liberal perspective, remember that conservatives are also against rampant inequality, and that Reagan’s budget director called Bush’s tax cuts for the wealthy “The biggest fiscal mistake in history”, saying that extending them won’t stimulate the economy).

And while many people believe that war helps stimulate the economy, that is a myth. The facts show that war – especially prolonged wars like we’ve had in Afghanistan and Iraq – destroy economies.

(Again, before you fall into a false left-right split, remember that true conservatives are anti-war), and that the top security experts – conservative hawks and liberal doves alike – agree that waging war in the Middle East weakens national security and increases terrorism. See this, this, this, this, this and this.)

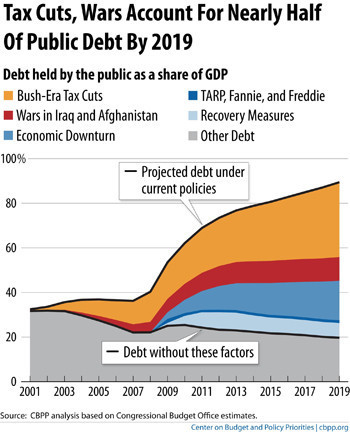

In fact, according to the non-partisan Center for Budget and Policy Priorities, the Bush-Obama tax cuts for the wealthy and the perpetual wars we’ve been waging for the last decade are by far the largest causes of our national debt:

Of course, while the Center for Budget and Policy Priorities downplays the role of the various bailouts in our debt situation, others might disagree. For example, I pointed out in December:

As I noted in December 2008, the big banks are the major reason why sovereign debt has become a crisis:

The Bank for International Settlements (BIS) is often called the “central banks’ central bank”, as it coordinates transactions between central banks.

BIS points out in a new report that the bank rescue packages have transferred significant risks onto government balance sheets, which is reflected in the corresponding widening of sovereign credit default swaps:

The scope and magnitude of the bank rescue packages also meant that significant risks had been transferred onto government balance sheets. This was particularly apparent in the market for CDS referencing sovereigns involved either in large individual bank rescues or in broad-based support packages for the financial sector, including the United States. While such CDS were thinly traded prior to the announced rescue packages, spreads widened suddenly on increased demand for credit protection, while corresponding financial sector spreads tightened.

In other words, by assuming huge portions of the risk from banks trading in toxic derivatives, and by spending trillions that they don’t have, central banks have put their countries at risk from default.

A study of 124 banking crises by the International Monetary Fund found that propping banks which are only pretending to be solvent hurts the economy:

Existing empirical research has shown that providing assistance to banks and their borrowers can be counterproductive, resulting in increased losses to banks, which often abuse forbearance to take unproductive risks at government expense. The typical result of forbearance is a deeper hole in the net worth of banks, crippling tax burdens to finance bank bailouts, and even more severe credit supply contraction and economic decline than would have occurred in the absence of forbearance.

Cross-country analysis to date also shows that accommodative policy measures (such as substantial liquidity support, explicit government guarantee on financial institutions’ liabilities and forbearance from prudential regulations) tend to be fiscally costly and that these particular policies do not necessarily accelerate the speed of economic recovery.

***

All too often, central banks privilege stability over cost in the heat of the containment phase: if so, they may too liberally extend loans to an illiquid bank which is almost certain to prove insolvent anyway. Also, closure of a nonviable bank is often delayed for too long, even when there are clear signs of insolvency (Lindgren, 2003). Since bank closures face many obstacles, there is a tendency to rely instead on blanket government guarantees which, if the government’s fiscal and political position makes them credible, can work albeit at the cost of placing the burden on the budget, typically squeezing future provision of needed public services.

Now, Greece, Portugal, Spain and many other European countries – as well as the U.S. and Japan – are facing serious debt crises. We are no longer wealthy enough to keep bailing out the bloated banks. See this, this, this, this, this and this. [and this and this.]

Indeed, the top independent experts say that the biggest banks are insolvent (see this, for example), as they have been many times before. By failing to break up the giant banks, the government will keep taking emergency measures (see this and this) to try to cover up their insolvency. But those measures drain the life blood out of the real economy.

And by failing to break them up, the government is guaranteeing that they will take crazily risky bets again and again, and the government will wrack up more and more debt bailing them out in the future. (Anyone who thinks that Congress will use the current financial regulation – Dodd-Frank – to break up banks in the middle of an even bigger crisis is dreaming. If the giant banks aren’t broken up now – when they are threatening to take down the world economy – they won’t be broken up next time they become insolvent either. And see this. In other words, there is no better time than today to break them up).

The bottom line is that the issue is not whether liberal “Keynesian” or conservative “austerity” philosophies are right. (The war between liberals and conservatives is a false divide-and-conquer dog-and-pony show. See this, this, this, this, this, this, this, this, this and this.)

The issues are pilfering of our economy by the wealthiest .1% and the waging of imperial wars for reasons other than our national security (and see this).

What's been said:

Discussions found on the web: