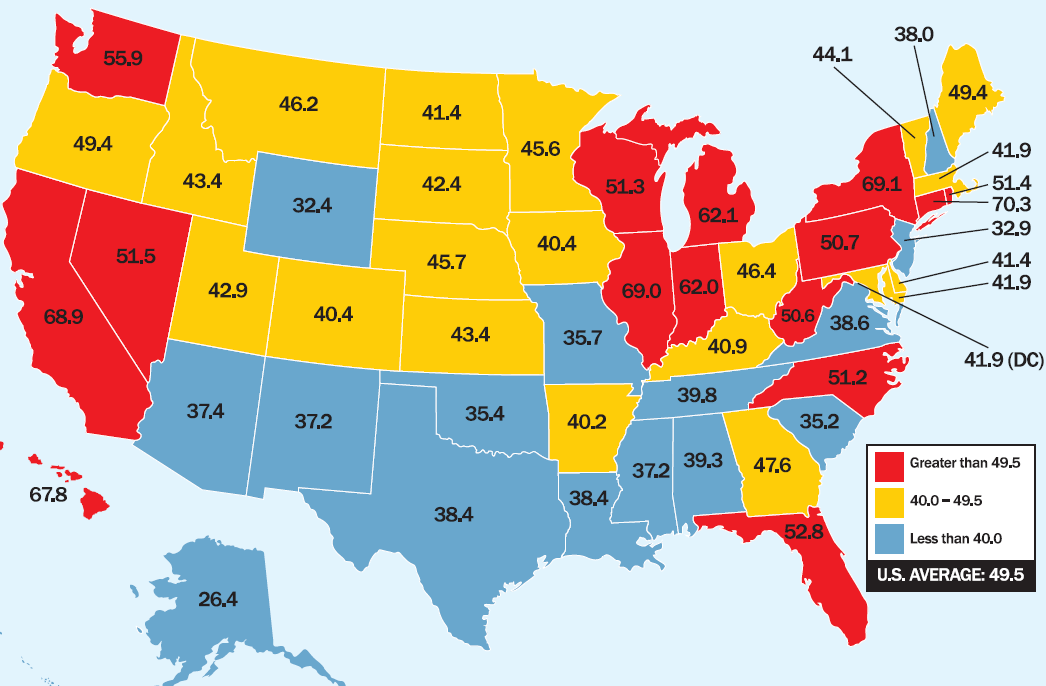

Interesting map, showing what each state charges in taxes for gasoline, per gallon. My home state, New York, appears to have highest gasoline taxes in the Nation. For those of you (us) who favor a Pigou tax, this is somewhat sobering . . .

>

click for larger graphic

via API.org

What's been said:

Discussions found on the web: