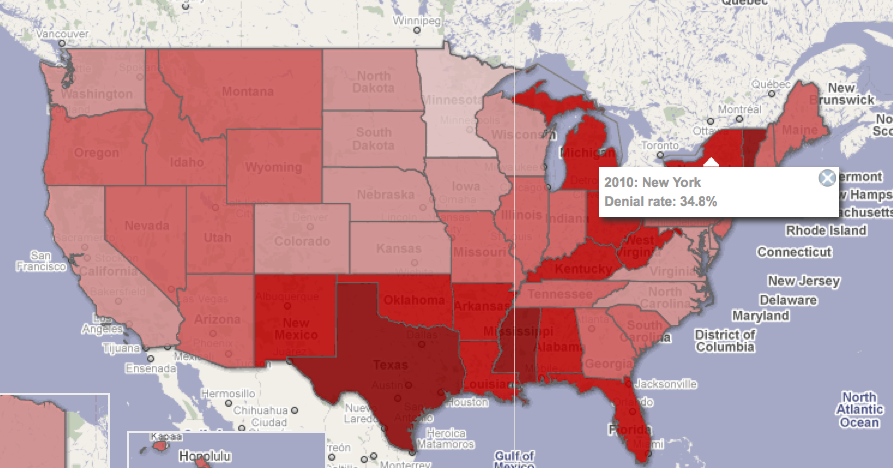

Mortgage application denial rates last year were highest in the South and along the Rust belt, according to a WSJ analysis.

Here’s the WSJ:

“The percentage of mortgage applications rejected by the nation’s largest lenders increased last year, spotlighting how banks’ cautious lending practices are hampering the nascent housing market recovery.

In all, the nation’s 10 largest mortgage lenders denied 26.8% of loan applications in 2010, an increase from 23.5% in 2009, according to an analysis by The Wall Street Journal of mortgage data filed with banking regulators.

Although lenders were expected to pull back from the freewheeling conditions that helped inflate the housing bubble, some economists argue they are now too conservative, and say that with the U.S. economy still wobbly, mortgages need to be easier to obtain for qualified borrowers, not harder.

The pendulum swings the other way . . .

>

Source:

Tighter Lending Crimps Housing

NICK TIMIRAOS And MAURICE TAMMAN

WSJ, JUNE 25, 2011

http://online.wsj.com/article/SB10001424052702304569504576405660006330644.html

What's been said:

Discussions found on the web: