From ARS technica, comes this assessment of what News Corp purchase of MySpace actually totaled: $1billion dollars: Doing the math on News Corp.’s disastrous MySpace years

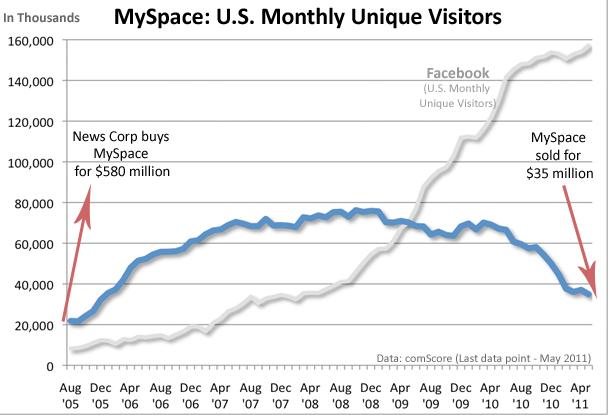

Business Insider musters up this chart to show just how a big a lead MySpace squandered over 3 years to allow Facebook to become the dominant player in the space:

>

What's been said:

Discussions found on the web: