A mention by David Rosenberg in a recent note sent me scurrying to find this report from the San Francisco Fed in August of last year. The report — remember, it was almost one year ago — used the Leading Economic Indicators to assess the probability of another recession within the next 24 months (from that date, obviously):

Statistical experiments with LEI data can mitigate these limitations and suggest that a recessionary relapse is a significant possibility sometime in the next two years.

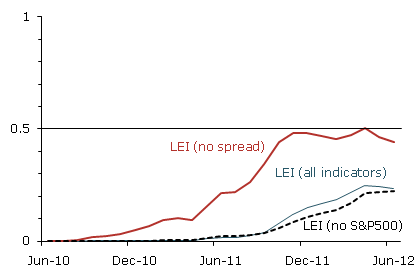

The most interesting aspect of their work is the authors’ removal of the yield curve spread (after all, the yield curve simply cannot invert with short rates at the zero bound) from their LEI-based analysis of recession probabilities. The result (emphasis mine):

The last experiment drops the spread between the Treasury bond and the federal funds rate from the 10 LEI indicators. Historically, this spread, which summarizes the slope of the interest rate term structure, has been a very good predictor of turning points 12 to 18 months into the future. Specifically, an inverted yield curve has preceded each of the last seven recessions. However, the term structure may not presently be an accurate signal. Monetary policy has been operating near the zero lower bound to provide maximum monetary stimulus. In addition, the Greek fiscal crisis has generated a considerable flight to quality that has pushed down yields on U.S. Treasury securities. Indeed, the thick red line in Figure 3 shows that omitting the rate-spread indicator generates far more pessimistic forecasts. For the period 18 to 24 months in the future, the probability of recession goes above 0.5, putting the odds of recession slightly above the odds of expansion.

Would seem that the economy is beginning to track as forecast by Mssrs. Berge and Jordà.

What's been said:

Discussions found on the web: