Click on chart for larger image

>

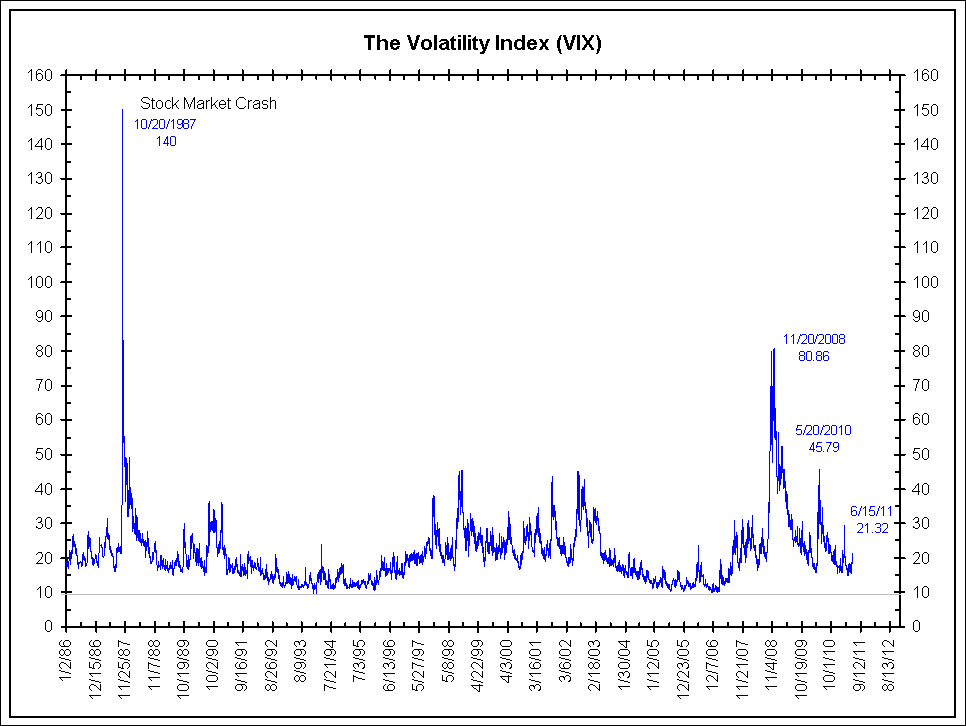

Despite the concern about the economy, Greece, China, etc., and general sentiment readings, the VIX remians surprisingly low:

BusinessWeek: No Panic in Options After VIX Takes Six Weeks to Exceed Average

It took six weeks of equity losses, a series of lower-than-estimated economic reports and political turmoil in Greece to finally drive the options gauge known as the VIX above its long-term average. The Chicago Board Options Exchange Volatility Index rose 17 percent to 21.32 yesterday, topping its 21-year mean of 20.34 for the first time since March 21, according to data compiled by Bloomberg. The VIX averaged 17.44 since the Standard & Poor’s 500 Index, the benchmark measure of U.S. stocks, began falling after reaching an almost three-year high on April 29. The options measure failed to surge even after the Citigroup Economic Surprise Index sank to minus 117.20 this month, meaning data missed projections in Bloomberg surveys by the most since January 2009. The response shows there’s no panic among investors buying and selling equity derivatives. . .”

Jim Bianco of notes the following about the VIX:

“In both normalized measurements, the present VIX reading is just over its trend curve. This is a market simply unwilling to acknowledge anything unusual might be underway.

As the spate of negative economic news and the largest one-day selloff since August 2010 have not been kept secret, we have to conclude one of two things: Either the options market is correct or option buyers have been blinded by, well, blind faith. It is quite possible the latest spate of negative news is simply one in a series of crises since March 2009 that have generated a great deal of excitement and then were buried in the next rally. For more than two years, the the bears have made the headlines and the bulls have made the money, much to the consternation of the bears.

Still, as noted in March, it would be better to see a rising VIX in such a situation. What never has changed and never can change are the mechanics of market-making; each purchase of protection in the put options market or in floating-rate receiving on variance swaps demands market makers sell ever-greater quantities of stock at ever lower prices to hedge. If the present complacence is incorrect, the subsequent adjustment will be harder and more violent than it would have been otherwise.”

What's been said:

Discussions found on the web: