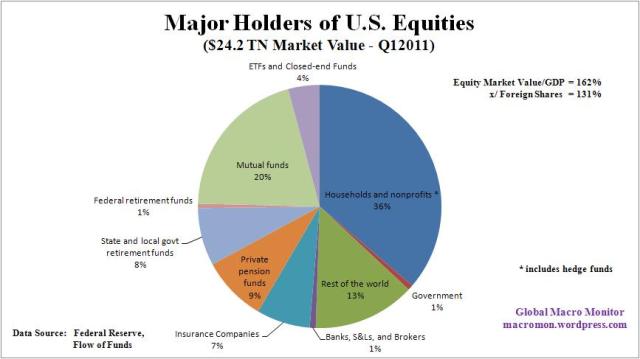

The following chart shows who holds U.S. equities, including foreign shares traded in the U.S.. at the end of March 2011. Notice that 36 percent of the market value of shares were held by the household sector. Our good friend, Charles Biderman of TrimTabs, does points out that the household sector includes “among other things, hedge funds, endowments, non-profit organizations, and direct purchases of equities by investors.” Furthermore, according to the Federal Reserve,

financial assets and liabilities of the household sector are largely derived as residuals because reports on the balance sheet activities of households are generally not available, except intermittently. In other words, the FFA starts with known economy wide totals for individual transaction categories and then amounts reported to be held by other sectors are deducted, leaving the household sector with the remainder. For most transaction categories, such as home mortgage debt and time deposits, this method seems reasonable because the household sector is the largest holder. Yet uncertainty about the accuracy of the asset and liability estimates in the FFA household sector remains and at times, the FFA estimates have been in question because of their residual nature.

Nevertheless, the chart does give a decent snapshot of the major holders of U.S. equities. Stay tuned, we will be back with more analysis on this topic. Click on chart for better resolution.

>

~~~

BR adds: Regular readers may recall that I have criticized some of Charles Biderman’s forecasts and commentary as disastrously wrong — see this, this, this and this — but I’ve found the money flows from TrimTabs to be what they do best.

What's been said:

Discussions found on the web: