>

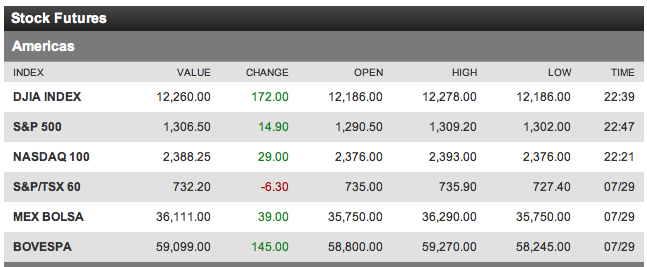

Okay, so we now have a deal, and the Futures are screaming higher. The decision not to sell into the weakness last week was so obvious it felt as if it was wrong.

The key for whether the market is topping out or starting a new leg upwards could very well be tomorrow’s trading and the few days that follows it. A strong market would gap up and ten keep going. Any failure to follow through, or — horrors! — a reversal spells trouble. A little upside volume would be nice as well.

More tomorrow . . .

What's been said:

Discussions found on the web: