Good Monday morning.

Systemic contagion is the order of the day. We awake to find Italy, the 3rd largest economy in Europe the EU, slipping into crisis. The EU has called emergency meetings to respond to yet another banking/credit crisis, which may be beyond the EU’s ability to throw money at. The European rescue fund now in place does not have enough assets to cover Italy’s problems. The cost of insuring against default on Portuguese, Irish and Greek government debt rose to records.

In a classic act of misdirection, Italy is ordering short sellers to disclose their positions, because after all, the entire European credit crisis was caused by analysts who identified over valued stocks. A whiff of desperation hangs over this diversionary action, reminscent of similarly foolish attempts done in 2008 in the US.

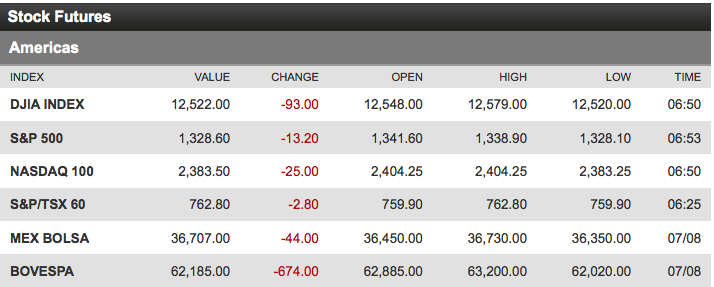

US futures have been falling all morning, looking like 0.75% drop.

The wild card in the US has been government rescues and the implicit (some say explicit) targeting of asset prices by the Fed. This has skewed the Trading action — there is a very rational fear amongst the short community of yet another ill-advised bailout of undeserving fools.

Sell offs have been shallow and contained, as we saw Friday after a simply god-awful jobs number. However, that may be coming to an end. Markets have risen on especially light volume, and the quarter ending window dressing we saw the half of June is suspect. Expectations for earnings seasons could be too high as well.

The bottom line remains: The Low hanging fruit in this rally appear to have been picked, and a modest correction appears to be underway. Markets have been modestly overbought, and in need of some corrective action. Whether this turns into anything more than a pullback off of recent highs will be determined in the coming days . . .

>

What's been said:

Discussions found on the web: