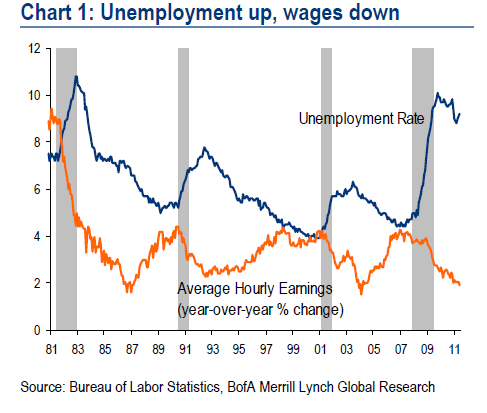

A Bank of America Merrill Lynch research note on the abysmal nonfarm payrolls number for June contained this graph:

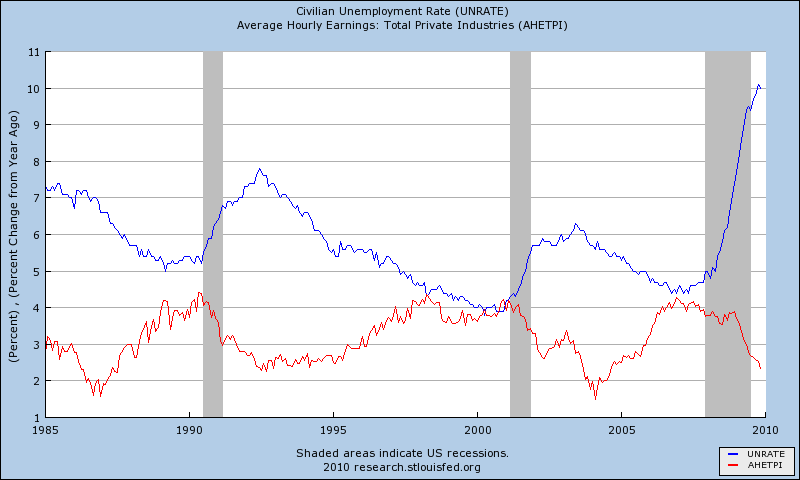

A February 2010 Big Picture post on slack in the labor market contained this graph:

My comment at the time, which holds true today:

I’d postulate that only when this gap starts to close meaningfully will we have to consider the possibility that the Fed will tighten and/or that inflation might be somewhere out there on the horizon. Until then, it’s very hard to envision they’ll consider moving off their ZIRP.

What's been said:

Discussions found on the web: