Not surprisingly, some of the conclusions and statements within the graphic are less than rigorous in their criticism:

>

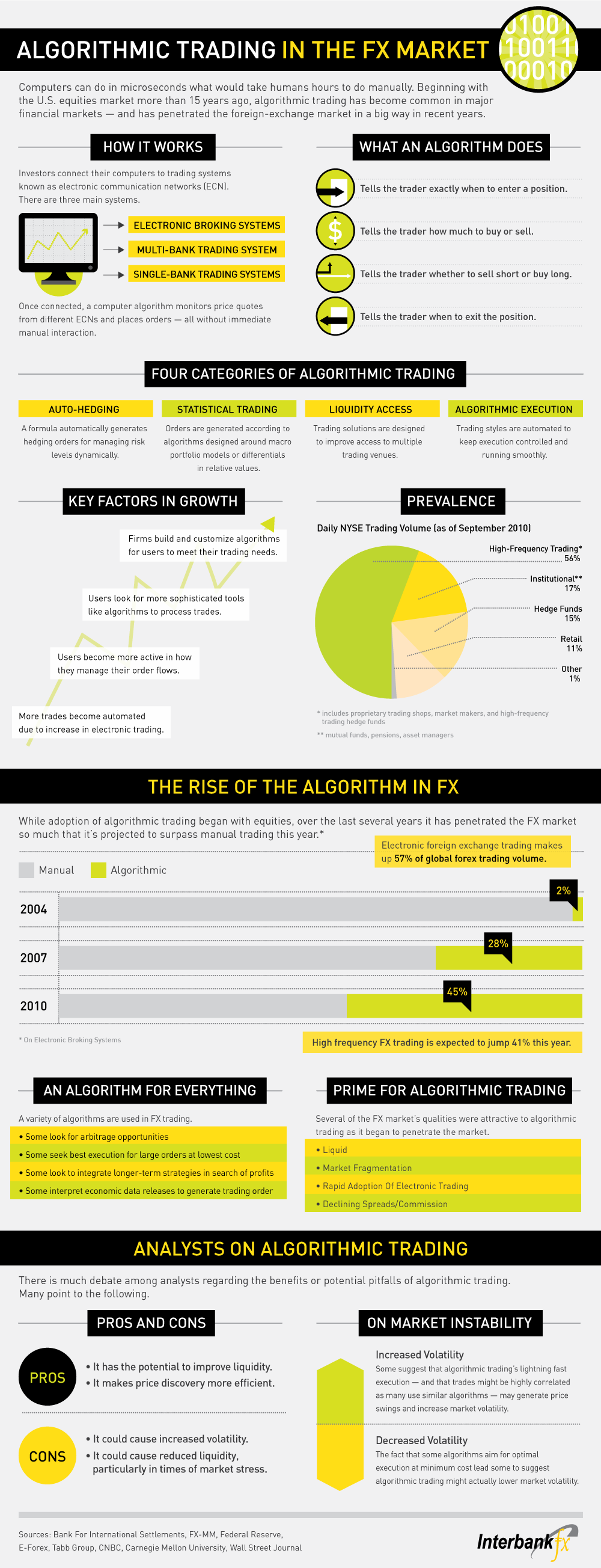

click for ginormous graphic

Interbank FX, Rise of the Algorithm

July 12, 2011

Not surprisingly, some of the conclusions and statements within the graphic are less than rigorous in their criticism:

>

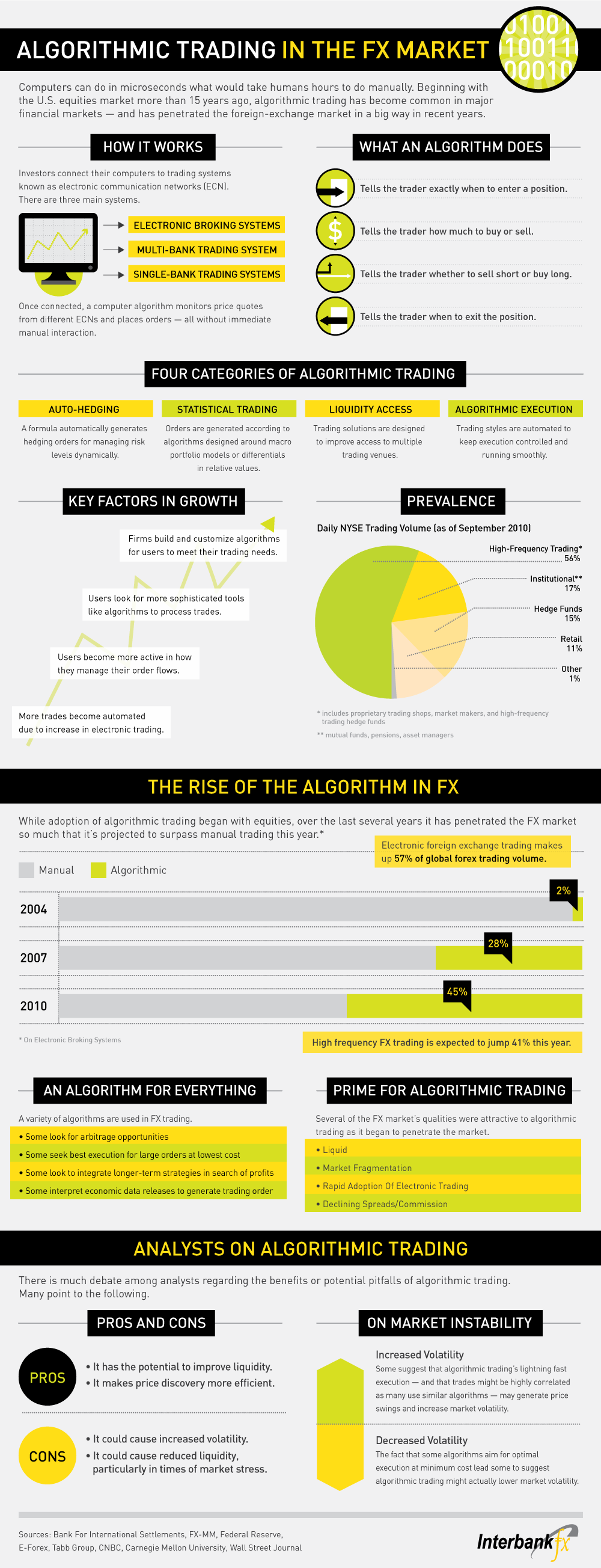

click for ginormous graphic

Interbank FX, Rise of the Algorithm

July 12, 2011

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: