>

My Sunday Washington Post column is out, and its titled “Note to investors: It takes longer to bounce back from a credit crisis” The online version gets a different title, Wall Street analysts and economists have this recession recovery wrong.

My Sunday Washington Post column is out, and its titled “Note to investors: It takes longer to bounce back from a credit crisis” The online version gets a different title, Wall Street analysts and economists have this recession recovery wrong.

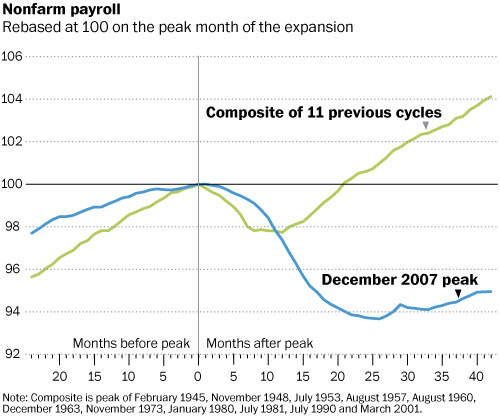

In it, I discuss how the post WW2 recession recovery cycle is the wrong frame of reference for looking at post credit crisis recoveries.

And while most Wall Street economists and analysts have gotten this entire cycle dead wrong, two academic economists standout as being prescient, before, during and after the crisis.

Here is a quick excerpt explaining how post credit cycles differ from ordinary recessions:

“Not only are credit crises different from other cycles, they also differ from other bubbles.

As Dan Gross explained in “Pop! Why Bubbles Are Great for the Economy,” the typical investing bubble leaves behind something of value. Whether it was thousands of miles of railroad tracks in the 19th century or thousands of miles of fiber-optic cables in the 1990s, usable infrastructure survives the bubble. Assets get scooped up out of bankruptcy for pennies on the dollar. Eventually, all of this overinvestment in the bubble du jour becomes a productive part of the economy. All that cable laid by Global Crossing and Metromedia Fiber and other bankrupt firms? Today, it is the bandwidth infrastructure that supports Google Maps, Netflix streaming video and Twitter.

Compare that with what gets left behind after a credit bubble bursts: No physical infrastructure, innovations or research breakthroughs; just soul-crushing, economy-sapping debt. And not just regular old balance-sheet obligations, but huge piles of counterproductive consumer and government liabilities.

Credit bubbles produce the exact opposite of productive resources. Deleveragers — those folks formerly known as consumers — spend the next decade paying down these obligations, rather than buying additional goods and services. And heavily indebted state and local governments are similarly thrifty, adding further pressure to the post-crisis economy.

Confusion about this is already taking a toll across the pond. The Irish, British and, soon, Greeks have bought into a misguided belief in austerity — that they can somehow cut their way to growth. In the United States, we have seen states and municipalities slashing head counts of teachers, cops and firemen. The “paradox of thrift” has morphed into a misguided economics of austerity. Hence, even when the private sector manages to create some jobs, its offset by public-sector job cuts.”

You can see the rest in either text or if you prefer PDF, click the image below:

click for PDF

>

Source:

Wall Street analysts and economists have this recession recovery wrong

Barry Ritholtz

Washington Post, July 17 2011

http://www.washingtonpost.com/business/wall-street-analysts-and-economists-have-this-recession-recovery-wrong/2011/07/14/gIQAVRTIGI_story.html

What's been said:

Discussions found on the web: