>

This week’s Washington Post column is out, and its a look at what led the Fed to its current situation. Pretty much out of bullets, and out of options.

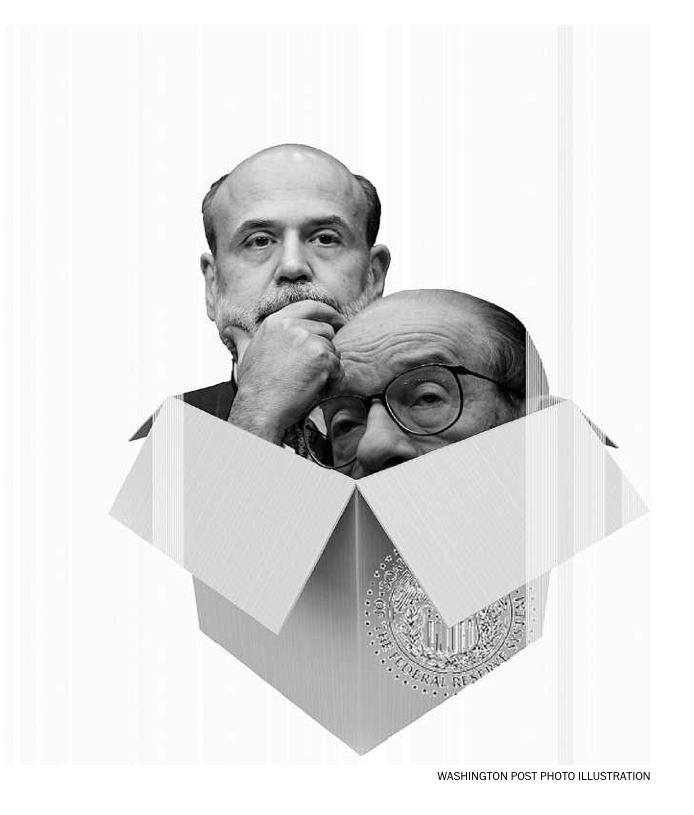

The online version is titled How the Federal Reserve boxed itself in, but I like the print version’s headline better: How the Fed boxed itself — and you

Here’s an excerpt:

“This unprecedented Fed intervention unleashed a series of unfortunate events: Bond managers scrambled for yield, ultimately finding AAA-rated mortgage-backed junk products. The dollar plummeted 41 percent over the next 7 years. Anything priced in dollars — oil, gold, foodstuffs — skyrocketed, sending inflation screaming higher. Housing took off, loan standards collapsed, credit quality suffered.

Of course, there were other factors: Radical deregulation, globalization, labor restructuring, flat income, the rise of Asia and more. But it’s hard to imagine the rest of the 2000s as the debacle it became without this initial Fed overreaction.

Indeed, we can only imagine what the 1990s and early 2000s would have been like had the FOMC been more Volcker and less Greenspan. Former Fed chair Paul A. Volcker was a no-nonsense central banker who believed that the Fed’s job was to fight inflation. Whatever happened in the stock market was none of his concern. If you bought Russian bonds and they defaulted, you were supposed to lose your money. Bought into a bad hedge fund that blew up? You took the hit! The dot-com collapse should have led to a flushing out recession and market crash that took a few years to recover from. Not, as was the case, an attempt to offer a salve to leveraged traders who were caught leaning the wrong way when the tide went out.

What we got instead was the Greenspan Fed. The ills caused by cheap money and excess liquidity were apparently to be solved by even cheaper money and more liquidity.

Many of the subsequent problems of the U.S. economy derive from those decisions from a decade or more ago. They have been compounded by a variety of other bad calls; it’s not all the Fed’s fault. But much of what ails us traces back to the Greenspan Fed.”

Regular readers of TBP or Bailout Nation will recognize many of the idea in the column…

>

click for ginormous dead tree print page image

>

Source:

How the Federal Reserve boxed itself in

Barry Ritholtz

Washington Post, August 14, 2011 page G6

http://www.washingtonpost.com/business/how-the-federal-reserve-boxed-itself-in/2011/08/08/gIQASpBYDJ_story.html

Dead tree version PDF

What's been said:

Discussions found on the web: