Macro Factors and their impact on Monetary Policy,

Macro Factors and their impact on Monetary Policy,

the Economy, and Financial Markets

MacroTides.newsletter-AT-gmail.com

Investment letter – August 17, 2011

l

What Happens When Monetary and Fiscal Policy Hit the Wall?

In 1978, Congress passed the “Full Employment and Balanced Growth Act”, which, in effect, expanded the reach of Congress beyond the use of just fiscal policy. The primary objective of the Act, also known as the Humphrey-Hawkins bill, was to add a second mandate to the Federal Reserve’s policy goals. In addition to conducting monetary policy to achieve price stability, the Act directed the Fed to strive for full employment. During the last 30 years, policy makers have attempted to use a combination of monetary and fiscal policy to mitigate the natural ebb and flow of the business cycle. In the 25 years between 1957 and 1982 (300 months), there were 64 months that the economy was in recession. In the 25 years between 1982 and 2007 (300 months) there were only two shallow recessions, which each lasted 8 months in 1991 and 2001. On the surface, it certainly appeared that the manipulation of monetary and fiscal policy had succeeded in taming the business cycle. In reality, the attempt to defeat the business cycle only succeeded in allowing far larger imbalances to develop. Since these imbalances took 20 to 30 years to develop, they have become structural in nature, and will require five to ten years to work through. As this adjustment period unfolds, our economy and financial markets will remain vulnerable to a heightened level of volatility. Since the secular bear market began in 2000, there have been large declines and solid rallies, and we expect that pattern to continue. Traditional asset allocation will not protect investors during market declines, so investors will not be able to simply buy and hold.

On the surface, it certainly appeared that the manipulation of monetary and fiscal policy had succeeded in taming the business cycle. In reality, the attempt to defeat the business cycle only succeeded in allowing far larger imbalances to develop. Since these imbalances took 20 to 30 years to develop, they have become structural in nature, and will require five to ten years to work through. As this adjustment period unfolds, our economy and financial markets will remain vulnerable to a heightened level of volatility. Since the secular bear market began in 2000, there have been large declines and solid rallies, and we expect that pattern to continue. Traditional asset allocation will not protect investors during market declines, so investors will not be able to simply buy and hold.

A quick review of the structural problems we’re facing will show why it will likely take five to ten years before a foundation is laid that will support a long term economic expansion.

During the window of apparent success, between 1982 and 2007, total debt relative to GDP, soared from $1.65 for each $1.00 of GDP in 1982, to $3.70 of debt for $1.00 of GDP in 2007. This increase occurred because debt was growing by more than 8% per year, while GDP was rising around 4% per year. (Chart pg. 1)

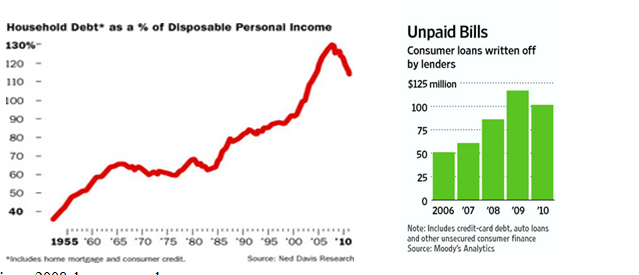

One of the big drivers in the increase in total debt was the significant increase in household debt, which mushroomed from 62% of disposable personal income in 1985 to 135% in 2008. At the end of 2010, the ratio was 120%.

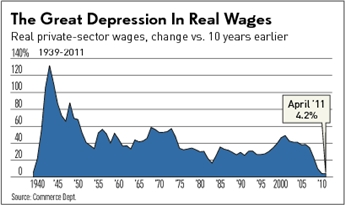

More than half of the $500 billion decline in household debt since 2008 has occurred as consumers defaulted on their mortgages, credit cards, and auto loans. It would have been far healthier if the ratio was due to healthy gains in disposable income. That’s not happening. According to the Commerce Department, real private sector wages have increased just 4.2% over the last decade.  For most of the past 35 years, the 10 year average increase in real wages has been more than 25%. This is the first recovery since World War II that there has been no gain in wages and salaries during the first eight quarters after a recession’s end. In the 1990’s, household debt as a percent of disposable income averaged 89%. The average household would need to cut $26,172 of debt to lower the household debt to 89%.

For most of the past 35 years, the 10 year average increase in real wages has been more than 25%. This is the first recovery since World War II that there has been no gain in wages and salaries during the first eight quarters after a recession’s end. In the 1990’s, household debt as a percent of disposable income averaged 89%. The average household would need to cut $26,172 of debt to lower the household debt to 89%.

A large portion of the increase in household debt occurred between 2002 and 2007, as homeowners withdrew $2.69 trillion of equity from their homes, according to the Federal Reserve. The conversion of home equity into consumer spending boosted GDP during those years. As consumers pay down debt, they will have less money to spend, which will result in slower GDP growth. To the extent that household debt is reduced through defaults, banks and other lenders will absorb the losses, which will continue to pressure credit availability in coming years.

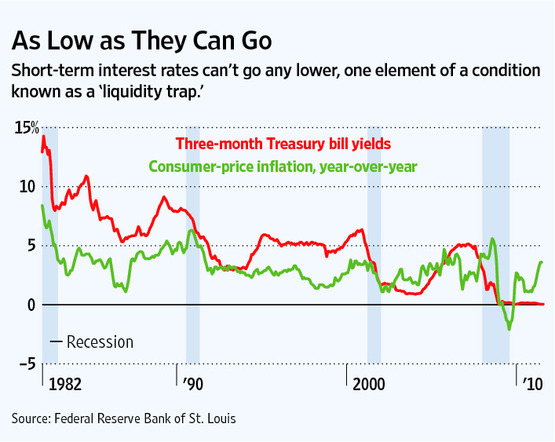

While the loosening of lending standards certainly played a role in accelerating the housing bubble, the primary driver behind the accumulation of debt was the decline in the cost of money. In 1981, the Federal funds rate exceeded 20%, and long term Treasury yields were north of 15%. As interest rates zigzagged lower between 1981 and 2001, consumers were able to increase their indebtedness, without a significant increase in their monthly payments. Today, the Federal funds rate is barely above 0%, and long term Treasury yields are under 4%. With interest rates at multi-generational lows, consumers’ debt burdens cannot be lessened by a meaningful drop in the cost of money. Consumers will have to pay down debt the old fashioned way – out of their wages and salaries.

On a side note, the lack of monetary discipline in the 1970’s indirectly contributed to our current dilemma. With Arthur Burns and G. William Miller at the helm of the Federal Reserve, excessive money supply led to the surge in inflation in the late 1970’s. Back then, the weekly money supply figures were show stoppers, if they jumped too much. Paul Volcker became Chairman of the Fed in 1979, and proceeded to squash inflation, but only after raising rates to unheard of levels. The instability generated by the surge in inflation during that period caused monetary policy to veer wildly. Just as a car driver can over correct if the car skids to the left, by swerving too much the right, the Fed responded to the inflationary imbalance with historically high rates, thus creating a different imbalance.

The apparent economic stability between 1982 and 2007 gradually led to more risk taking in the financial markets. This process was reinforced after the Federal Reserve flooded the financial system with liquidity, which contained the 1987 crash in the stock market and the fallout from the collapse of Long Term Capital Management in 1998. To offset the collapse in business investment after the dot.com bust in 2001, the Federal Reserve slashed interest rates to keep demand for autos and housing strong. Market participants referred to the Fed’s intervention as the Greenspan Put. They believed the Fed would ride to the rescue anytime the market stumbled, which only served to embolden traders. In 2004, investment banks petitioned the Securities and Exchange Commission to allow an increase in operating leverage from 12 to 1, to 30 to 1. This allowed banks to borrow $30 for each $1 of capital. Their timing was perfect, as they leveraged their balance sheets on housing, which by 2006 was 50% overvalued. The rest as they say is history.

Since the 1930’s, Keynesian economics has directed the execution of fiscal policy. Whenever private demand flagged, Congress ramped up government spending to offset lower consumption. In theory, budget deficits during periods of recession were to be corrected by budget surpluses during economic expansions. In practice, politicians rarely curbed spending when the economy was growing. In the last 60 years, there have been 3 years when the government ran a surplus. More than 60% of federal spending is mandated by law, while less than 15% of this year’s budget is discretionary. With so much government spending on autopilot, it is very difficult to reduce the automatic increases in government spending. In Washington D.C., there are no cuts in government spending, only misleading terminology that both parties use. If nothing is done to address the budget deficit, government spending will grow on average 4.7% annually for the next 10 years. The plan put forth by the Gang of Six would allow government spending to grow by 3% per year over the next decade. In an example of stunning hyperbole (except they were serious) a New York Times editorial said these ‘cuts’ would eviscerate Medicare. Really?

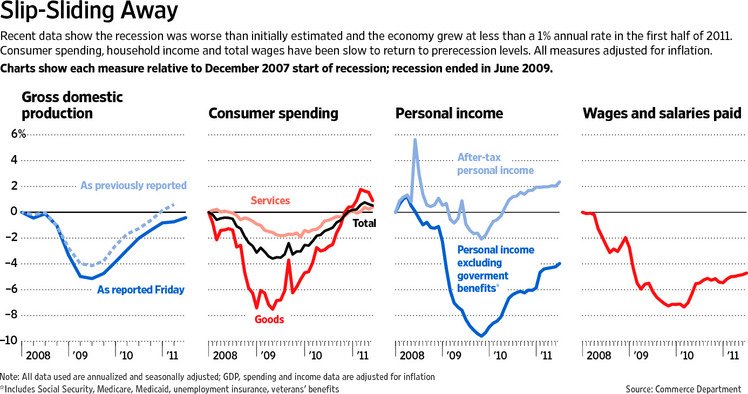

In the wake of the financial crisis in 2008, consumer demand collapsed, and GDP shrunk by 5%. The Federal government increased spending and tax receipts plunged, which resulted in a budget deficit of 10% of GDP. Despite this historic level of fiscal stimulus, personal income is actually 4% below the peak in 2007. However, when government income transfer programs are included (i.e. unemployment benefits, food stamps for more than 40 million Americans, etc.), personal income is 4% above its 2007 high. Basically, the Federal government borrowed almost $1.5 trillion in order to extend unemployment benefits to 99 weeks from 26 weeks, provide substantial aid to state governments, and maintain other assistance programs. Without the demand funded by government assistance, the recession would have been deeper and the recovery even weaker than it has been.

The hope and goal of policy makers has been that the combination of monetary and fiscal stimulus would buy enough time for a self sustainable economy recovery to take hold, as it has in the past. Recent revisions to GDP indicate the recession was deeper and the recovery weaker than previously thought, which supports our view that a self sustainable recovery has not taken hold. Policy makers are now facing a stark reality, especially if the economy weakens further and the risks of another recession rise. Monetary policy is running on empty, and there isn’t a gas station in sight. The Federal Reserve has promised to keep the Federal funds rate anchored just above 0% for two years.

The hope and goal of policy makers has been that the combination of monetary and fiscal stimulus would buy enough time for a self sustainable economy recovery to take hold, as it has in the past. Recent revisions to GDP indicate the recession was deeper and the recovery weaker than previously thought, which supports our view that a self sustainable recovery has not taken hold. Policy makers are now facing a stark reality, especially if the economy weakens further and the risks of another recession rise. Monetary policy is running on empty, and there isn’t a gas station in sight. The Federal Reserve has promised to keep the Federal funds rate anchored just above 0% for two years. This sleight of hand provides no additional monetary stimulus. After the announcement, not a single bank lowered their Prime rate, nor did credit card companies lower their usury rates on unpaid balances. The Fed isn’t pushing on a string, they’re pushing on a strand of hair.

This sleight of hand provides no additional monetary stimulus. After the announcement, not a single bank lowered their Prime rate, nor did credit card companies lower their usury rates on unpaid balances. The Fed isn’t pushing on a string, they’re pushing on a strand of hair.

After three years of $1 trillion+ annual deficits, it is going to be difficult to even maintain the current level of government support, when unemployment benefits expire at the end of this year for 8.9 million unemployed workers, as does the 2% reduction in payroll taxes for all workers. According to Goldman Sachs, first quarter GDP in 2012, could be lowered by as much as 1.5%, if the payroll tax cut is allowed to expire. The Congressional Budget Office estimates that Federal government spending is down nearly 12% from May 2010. In the first two quarters of 2011, lowered spending by all levels of government reduced GDP by an average of .7%. Reducing Federal spending from 25% of GDP to the long term average of 19% over the next 10 years is the right medicine for the long term health of our economy. But in the short run, it will make the patient weaker.

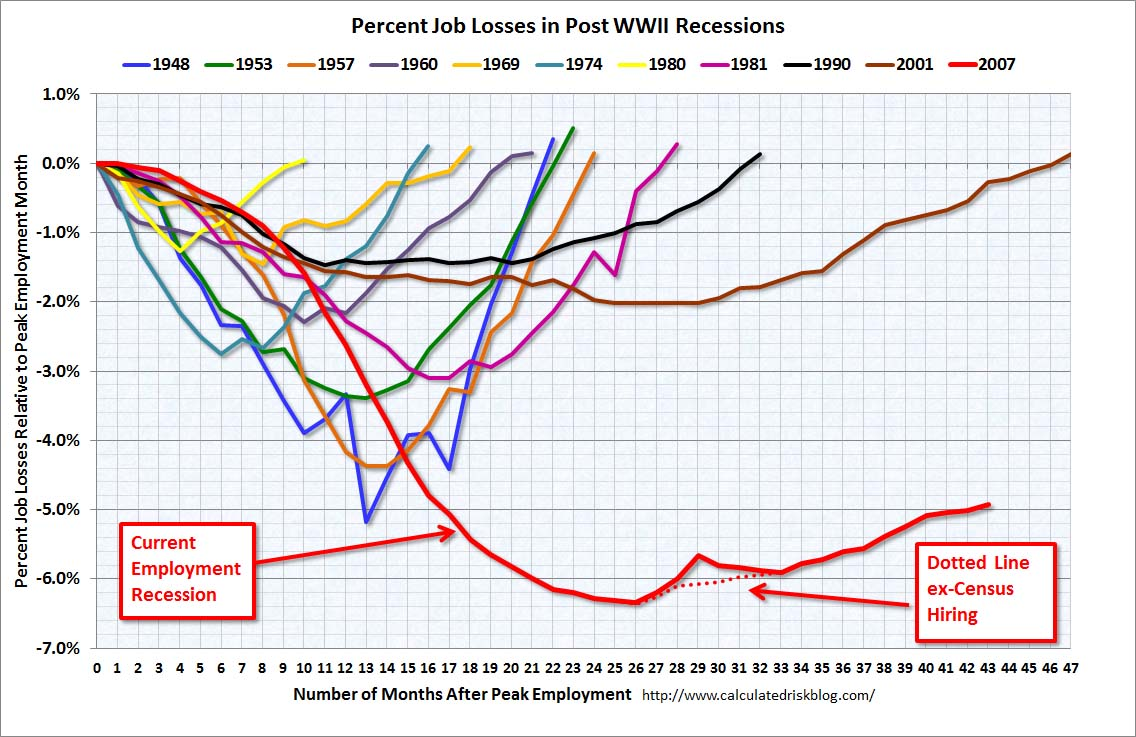

Since the recovery began in June 2009, the labor market has been exceptionally weak. The labor force participation rate measures the share of the working age population that is employed or looking for work. In July, the participation rate fell to 63.9%, the lowest since January 1984. Of the 13.9 million unemployed workers, 6.2 million have been looking for work more than six months. Another 1.1 million unemployed workers have simply given up looking. In nine of the eleven recessions since 1948, all the jobs lost during the recession were recovered within 32 months, with most recoveries recouping all the lost jobs in less than 24 months. The two exceptions were the 2001 recession, which took 46 months, and now. It’s been 43 months and 5% of the labor force is still unemployed. This is unprecedented.

Since the recovery began in June 2009, the labor market has been exceptionally weak. The labor force participation rate measures the share of the working age population that is employed or looking for work. In July, the participation rate fell to 63.9%, the lowest since January 1984. Of the 13.9 million unemployed workers, 6.2 million have been looking for work more than six months. Another 1.1 million unemployed workers have simply given up looking. In nine of the eleven recessions since 1948, all the jobs lost during the recession were recovered within 32 months, with most recoveries recouping all the lost jobs in less than 24 months. The two exceptions were the 2001 recession, which took 46 months, and now. It’s been 43 months and 5% of the labor force is still unemployed. This is unprecedented.

The depth and lack of a meaningful recovery in the labor market since June 2009 suggests this is another structural problem that has multiple facets. The lack of job growth will weigh on GDP growth, and make it far more difficult at all levels of government to balance their budgets, since the unemployed have less money to spend, which reduces sales taxes. They also pay no income taxes to states or the Federal government. And, unless unemployment benefits are cut off at the end of 2011, spending will remain elevated to keep benefits in place. Future productivity will also be less, as job skills erode the longer a person is out of work.

Approximately 27% of homeowners with a mortgage are under water. Unless they have the financial wherewithal to make up the short fall, they are effectively trapped in their home and removed from future demand. Banks have increased lending standards, often requiring a 20% down payment, thereby excluding a good number of homebuyers who would have qualified easily in the past. More than 60% of all the homes in the foreclosure pipeline have yet to hit the market. As these homes are sold, they will put downward pressure on surrounding properties. The imbalance between supply and demand in most markets will keep home prices at best flat, with the weaker markets losing another 5% to 10%. We don’t see a meaningful recovery in home prices until 2013.

Approximately 27% of homeowners with a mortgage are under water. Unless they have the financial wherewithal to make up the short fall, they are effectively trapped in their home and removed from future demand. Banks have increased lending standards, often requiring a 20% down payment, thereby excluding a good number of homebuyers who would have qualified easily in the past. More than 60% of all the homes in the foreclosure pipeline have yet to hit the market. As these homes are sold, they will put downward pressure on surrounding properties. The imbalance between supply and demand in most markets will keep home prices at best flat, with the weaker markets losing another 5% to 10%. We don’t see a meaningful recovery in home prices until 2013.

According to a working paper by Federal Reserve staff, it can take at least two years and usually five years for property assessments to catch up to market values. Nationwide home prices are down more than 30%, which means real estate taxes have a long way to fall in coming years. Since real estate taxes provide 30% of revenue for local government, many municipalities will be forced to cut police and firefighters. As teachers are given pink slips, class sizes will increase significantly. Some municipalities have, and more will increase real estate tax rates out of desperation to make up for the shortfall in tax revenue, rather than make unpopular cuts in vital services.

Another challenge facing many states is funding the pensions of retired workers. Many states allow workers to retire at age 57 with full benefits, as long as they have 30 years of service. Police officers and firefighters can retire at age 53 with 25 years of service. Average life expectancy is 78.2 years for men and 82 years for women. This means some state workers will receive full pension benefits for almost as long as they worked for the state. In determining their annual contribution to their pension funds for future retirees, many states have assumed an average annual return of 7.5% to 8% on existing pension assets and future contributions. With the yield on the 30-year Treasury bond under 4%, it is going to be difficult for states to achieve such a high rate of return. Based on the rule of 72, money doubles every 9 years if the annual return averages 8%. If the annual return is 6%, it takes 12 years for money to double, or 33% longer. According to Joshua Rauh, an associate professor of finance at Northwestern University, if states used an insurance company’s actuarial model, their annual contributions might have to double or triple from current levels to ensure they have enough money to meet future retirement benefits. The problem for most states is that they don’t have the money to increase their contributions. This means future liabilities are only going to get larger.

As we can see, these structural problems suggest it will likely take five to ten years before a foundation is laid that will support a long term economic expansion.

The Developed Nations

Unfortunately, the myriad of structural problems facing the United States are also prevalent in Japan, Great Britain, and the majority of countries in the European Union. Since these countries comprise almost 65% of world GDP, global growth will be slower in coming years. Japan has been dealing with economic stagnation for more than 20 years, even though interest rates have been near 0%, and excessive government spending has pushed debt to 200% of GDP. Great Britain has adopted a fairly austere fiscal policy, even as their economy limps along.

Unfortunately, the myriad of structural problems facing the United States are also prevalent in Japan, Great Britain, and the majority of countries in the European Union. Since these countries comprise almost 65% of world GDP, global growth will be slower in coming years. Japan has been dealing with economic stagnation for more than 20 years, even though interest rates have been near 0%, and excessive government spending has pushed debt to 200% of GDP. Great Britain has adopted a fairly austere fiscal policy, even as their economy limps along.

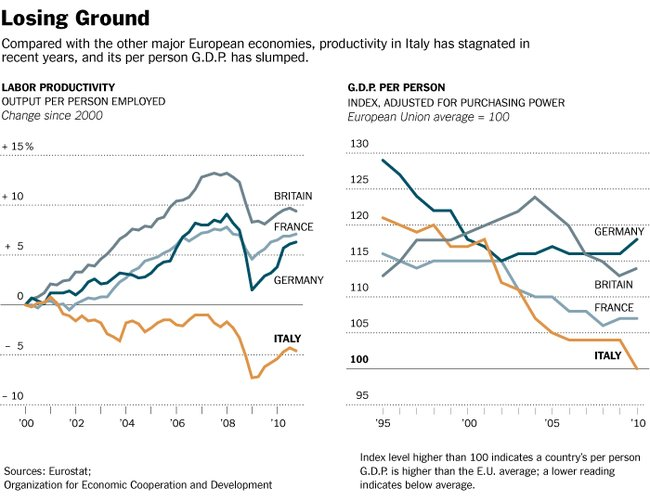

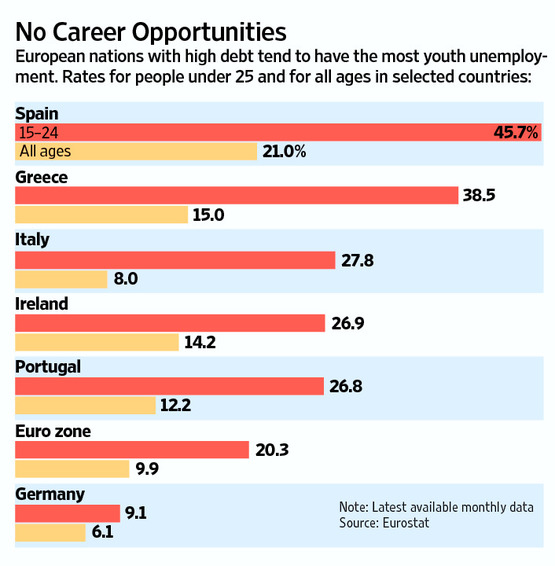

It has been our view that it was just a question of when Europe would blow up, not if. But even we were a bit surprised that the plan announced on July 21 to solve the EU’s debt problems didn’t keep rates in check in Spain and Italy for more than a week. One of the major challenges facing Italy and Greece is low productivity, especially when compared to Germany. The underlying problem for these countries is servicing debt, while economic growth remains sluggish. Until job growth improves, overall economic growth will remain muted. The lack of job growth among those under 25 will increasingly pose a serious social problem, and potentially a destabilizing force as we have seen in a number of Middle Eastern countries. The average level of unemployment for those under 25 in the E.U. is 20.3%, which is bad enough. In Spain, youth unemployment is over 45%, with rates of 38.5% for Greece, and almost 28% for Italy, Ireland, and Portugal. Countries with chronic high levels of youth unemployment are ripe for a revolution, and often see their governments toppled.

It has been our view that it was just a question of when Europe would blow up, not if. But even we were a bit surprised that the plan announced on July 21 to solve the EU’s debt problems didn’t keep rates in check in Spain and Italy for more than a week. One of the major challenges facing Italy and Greece is low productivity, especially when compared to Germany. The underlying problem for these countries is servicing debt, while economic growth remains sluggish. Until job growth improves, overall economic growth will remain muted. The lack of job growth among those under 25 will increasingly pose a serious social problem, and potentially a destabilizing force as we have seen in a number of Middle Eastern countries. The average level of unemployment for those under 25 in the E.U. is 20.3%, which is bad enough. In Spain, youth unemployment is over 45%, with rates of 38.5% for Greece, and almost 28% for Italy, Ireland, and Portugal. Countries with chronic high levels of youth unemployment are ripe for a revolution, and often see their governments toppled.

Economic growth slowed in the second quarter for the 17 countries in the Eurozone to just .2%, down from .8% in the first quarter. Slow growth increases the burden from high levels of debt, making it tougher for countries to narrow budget deficits and reduce unemployment. The ECB, much like the Federal Reserve, will take whatever action needed to buy more time, in hopes that eventually a true recovery will take hold in the weakest countries within the E.U. We do not think they will be successful. There is simply too much debt, and not enough economic growth to support or service current debt levels.

Brazil, China, and India

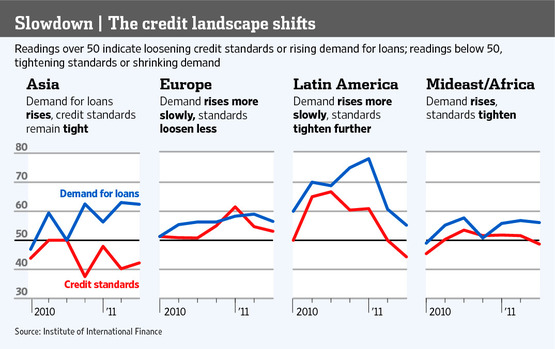

Coming into 2011, we felt the tightening of monetary policy by Brazil, China, and India would continue, and lead to a second half slowing in these high growth economies. In the first half of this year, all three countries tightened monetary policy further, and there are signs that these economies have begun to slow. In Asia, credit standards turned negative in the third quarter of last year, and have remained relatively tight. Credit standards in Latin America turned negative in the second quarter of this year. Normally, it takes from 6 to 9 months, before tightening monetary policy slows economic growth. Inflation in all three countries has continued to push higher, so a reversal in monetary policy is unlikely in the near term. The recent decline in U.S. equity prices caused the stock markets in all three countries to break down, and enter a bear market.

Coming into 2011, we felt the tightening of monetary policy by Brazil, China, and India would continue, and lead to a second half slowing in these high growth economies. In the first half of this year, all three countries tightened monetary policy further, and there are signs that these economies have begun to slow. In Asia, credit standards turned negative in the third quarter of last year, and have remained relatively tight. Credit standards in Latin America turned negative in the second quarter of this year. Normally, it takes from 6 to 9 months, before tightening monetary policy slows economic growth. Inflation in all three countries has continued to push higher, so a reversal in monetary policy is unlikely in the near term. The recent decline in U.S. equity prices caused the stock markets in all three countries to break down, and enter a bear market.

Stocks

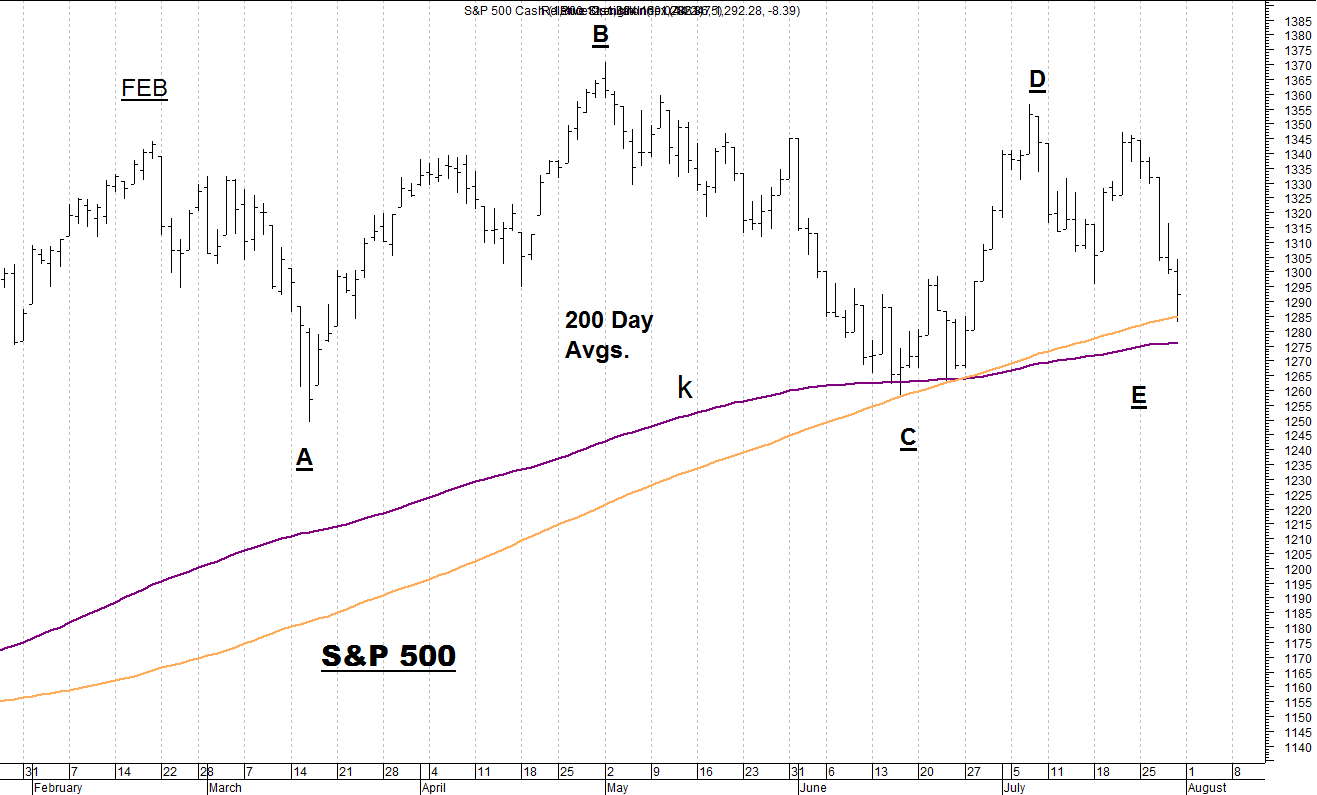

In the July 20 issue of Macro Tides we presented the chart below with the following analysis. “It appears that the S&P is tracing out a 5 point triangle, as denoted by the A, B, C, D, and E on the chart below. While not necessary, there may be one more dip below Monday’s low at 1295, before a substantial rally above 1,370 commences. If this analysis is correct, the S&P should not close below 1258. In the July 31 Special Update, we said, ”If the S&P drops below 1,258, it will likely drop under 1,200 in short order, before a rebound develops.”

After the S&P closed below 1,258 on August 2, we moved our managed accounts 100% out of the market on August 3. The S&P plunged 54 points on August 4, dropping below 1,200 in the process. Although we were wrong about one final rally above 1,370, we were right in understanding the importance of 1,258 on the S&P. Sometimes knowing when we are wrong is more important than being right. Our recommended purchases of the S&P 500 ETF (SPY) on June 13 @ $127.89, and on July 29 @ $128.91 was stopped on August 3 at $125.00.

Our investment model suggests that the secular bear market that began in 2000 has resumed, and the cyclical bull market from March 2009 has ended. We will note that the model dipped into bear market territory between June and August 2010. The market then held, and reversed higher, after the Federal Reserve indicated that it would undertake QE2. Our model turned bullish on September 3, 2010.

Chariman Bernanke made the QE2 announcement in a speech at the Federal Reserve Bank of Kansas City’s Economic Symposium in jackson Hole, Wyoming on August 27, 2010. Coincidently, this year’s symposium is being held on August 26. We suspect investors will be hoping (praying?) for a repeat performance. The anticipation of his speech may help the market to hold up until then. If you didn’t do some selling when the S&P broke 1,258, we recommend selling into any strength in coming days. After a breakdown, the market will occasionally return to the ‘scene of the crime’. In this case, that would be 1,225 – 1,250.

We think it is unlikely the Fed will begin QE3 so soon, which should prove disappointing. We expect the S&P to fall below its recent low at 1,101. The low in March 2009 was 666 on the S&P, and the peak of the cyclical bull market was 1,370. The 50% retracement level of the rally is 1,020. The range between 1,020 and 1,050 should provide some support.

Given our negative outlook for the U.S. and global economy, we think the Fed will be pressed to eventually undertake QE3. Our guess is additional weakness in the U.S. economy, a break down in the European banking system, and lower stock prices will act as the catalyst.

Bonds

We expected the yield on the 10-year Treasury bond to remain range bound, between 2.6% and 3.65%. In the June letter we noted, “If the economy grows as slowly as we expect in the second half, and the risk of a European debt crisis remains visible on the horizon, there is no compelling reason to sell Treasury bonds.” The resumption of problems in the European Union, and the breakdown in the stock market, caused the 10-year yield to break below 2.6%. It subsequently fell to 2.03%, which matched the low in December 2008. The decline in bond yields was all the more remarkable, since it happened after S&P lowered the credit rating of the U.S. As long as the yield is below 2.7%, we view it as a warning sign of further banking problems in Europe, and economic weakness in the U.S.

Dollar

In our May letter we recommended going long the Dollar via its ETF (UUP) at $21.56, and in June recommended holding the position. In our July 31 Special Update, we suggested adding to the UUP position below $20.91, which was triggered today, August 17. Use 20.74 as a stop.

Gold

In the June letter, we suggested aggressive traders establish a small short position at $1,550, and add to it at $1,587.00. The stop at $1, 648.50 was triggered.

Macro Tides

What's been said:

Discussions found on the web: