Today’s reading list:

• Bernanke’s Interest-Rate Timeframe Draws Most Negative Votes in 18 Years (Bloomberg) see also Why Fed Move May Have Pushed Investors Into Stocks (WSJ)

• Mark Cuban: What Business is Wall Street In ? (Maverick)

• Earnings: The Last Economic Bright Spot (Slate)

• S&P balks at SEC proposal to reveal rating errors (Reuters)

• How to ‘fix’ a market (NY Post)

• The Danger to China’s Economy (The Diplomat)

• Global Economic Downturn: A Crisis of Political Economy (Stratfor) see also The U.S. Economy Feels the Pull of Gravity (Businessweek)

• London riots: the underclass lashes out (Telegraph)

• Yahoo Discount Means U.S. Web Portal Free in Takeover: Real M&A (Bloomberg)

• God’s Blog (New Yorker)

What are you reading?

>

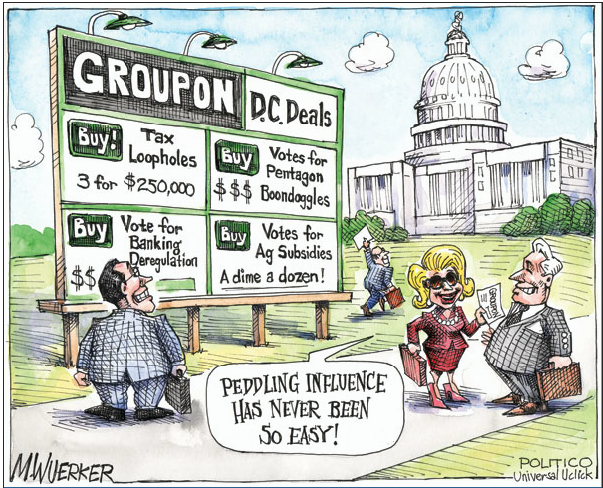

And in light of the Groupon filing:

Wuerker via Politico

What's been said:

Discussions found on the web: