Interesting Neurological discussion of investor foibles:

“It’s a heretical thought on Wall Street, where most people insist that logic prevails. The economic theory of rational expectations has enshrined the principle that people make judicious economic choices and learn from their mistakes. As a result, our collective expectations about the financial future — from the price of T-bills next week to the earnings of Google next quarter — are, on average, accurate.

Or so the theory goes. In practice, we do stupid things all the time. Some of us gamble away money, doubling down when logic tells us to quit. Others let their winnings ride when any rational person would cash out.

But many experts say the 2008 financial collapse recalibrated investor psychology. After living through the collapse of Lehman Brothers and the panic that followed, some investors are apt to sell first and ask questions later. Wall Street’s notion of worst-case scenarios has darkened considerably.”

Worth a read . . .

>

Source:

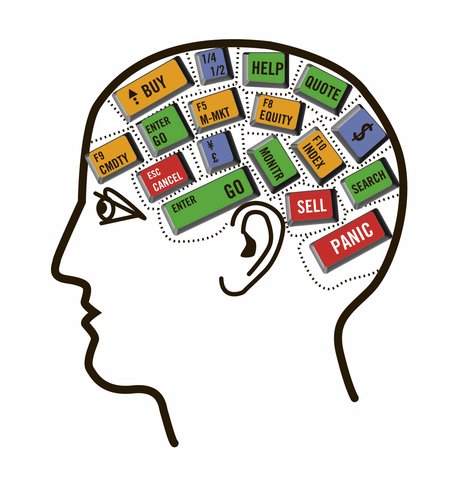

Pressing All the Buttons for a Panic Attack

JULIE CRESWELL

NYT, August 6, 2011

http://www.nytimes.com/2011/08/07/business/neurofinance-shows-how-investors-can-shun-reason.html

What's been said:

Discussions found on the web: