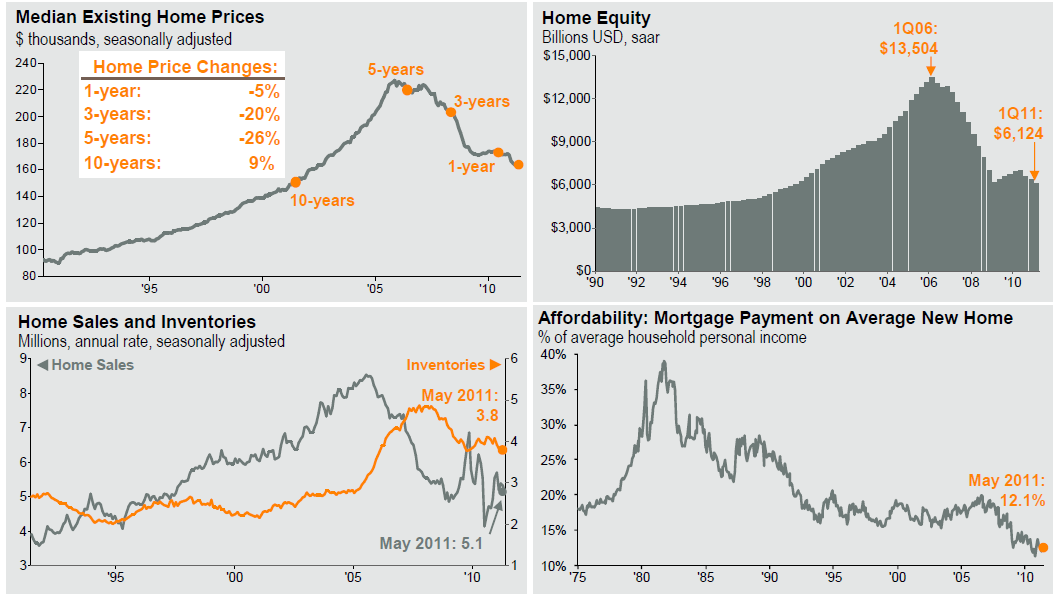

Relative to this morning’s post on RE, have a look at these charts (via JP Morgan) — none of suggest anything other than more work to be done in the RE sector.

>

Source: BLS, FactSet, J.P. Morgan Asset Management.

Data reflect most recently available as of 6/30/11.

What's been said:

Discussions found on the web: