The latest adds to my Instapaper:

• Stop the Panic. It’s Not 2008. (Daily Beast)

• What HFT Hedge Funds Tell Us About Carried Interest (Obsolete Dogma)

• Gold’s climb is perfectly rational (CNN Money)

• What Is Business Waiting For? (NYT) see also It’s the Aggregate Demand, Stupid (Economix)

• Debt Crisis Threatens to Taint Broader Economy (NYT)

• Tax the super-rich or riots will rage in 2012 (Market Watch)

• The moral decay of our society is as bad at the top as the bottom (Telegraph)

• Five Tips for Marketers From MTV’s Study of Millennials’ Digital Habits (Ad Age)

• The Death of Booting Up (Slate) see also Microsoft Faces the Post-PC World (WSJ)

• MPAA Lobbies For Wall Street Reform (Torrent Freak)

What are you reading?

>

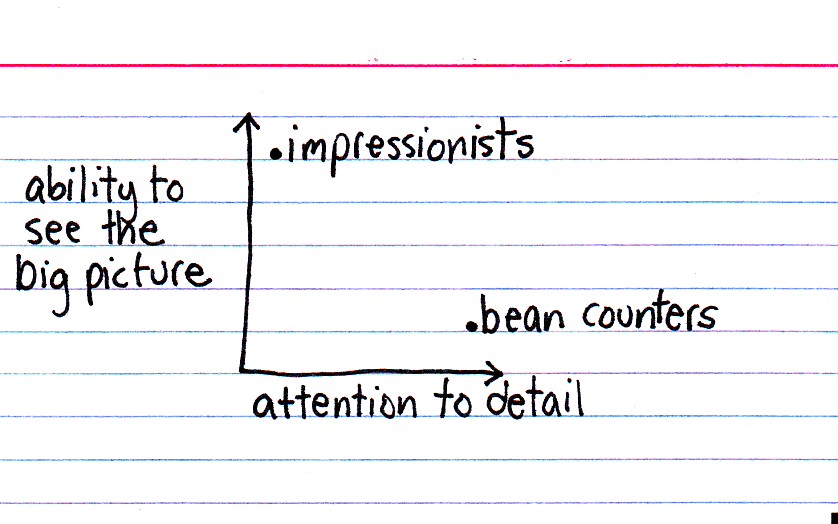

click for larger graphic

via Indexed

What's been said:

Discussions found on the web: