Here is what I am reading today:

• Our Sputtering Economy, by the Numbers (Pro Publica)

• For states, debt deal is short on details (Stateline)

• More people borrowing from 401(k) accounts (McClatchy)

• AAA Rating Is a Rarity in Business (NYT) see also Moody’s Affirms U.S. Rating, Warns of Downgrades (Bloomberg)

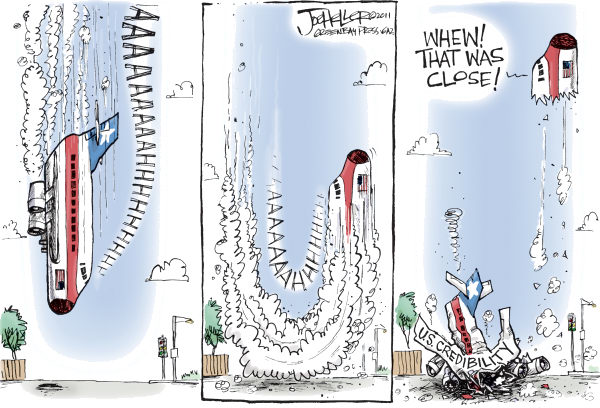

• The wilful ignorance that has dragged the US to the brink (The Independent)

• Who gains from debt deal? The Pentagon, for one (McClatchy)

• The economics of humiliation (Market Place)

• Obama Bonds Proved World Beaters in Game of Chicken on Debt (Bloomberg)

• What The NYC Startup World Needs (And Doesn’t Need) (Chris Dixon’s Blog)

• Alternative TV Opening Credits (Short List)

What are you reading?

>

What's been said:

Discussions found on the web: