In July 2010, Bianco Reserch highlighted an analysis by Ron Griess at TheChartStore.com of every instance of the death cross (aka dark cross) since 1930. Below are his results.

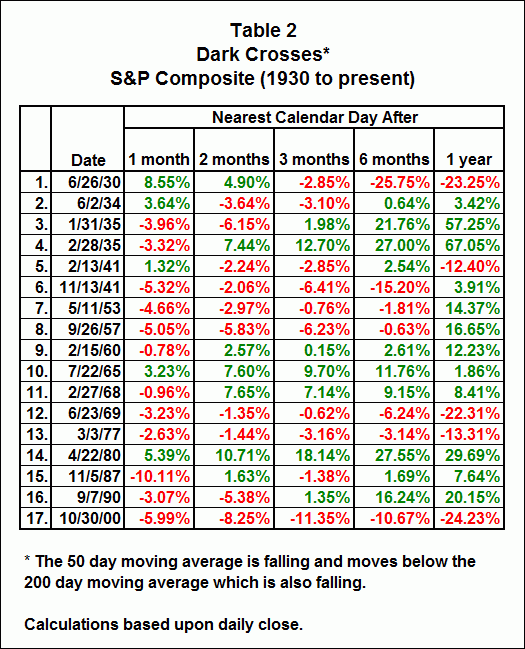

The first table shows the performance of the S&P Composite for the time periods listed when the 50-day moving average is falling and crosses a rising 200-day moving average. (Dark Cross)

The second table shows the performance of the S&P Composite for the time periods listed when the 50-day moving average is falling and crosses a falling 200-day moving average. (Death Cross)

The bottom line: There are lots of things to worry about, but this is not one of them — its a low probability indicator:

>

Dark Cross

50-day ma falling across a rising 200-day moving average.

What's been said:

Discussions found on the web: