These are the items I am reading this morning:

• U.S. Investing: Are the Best Times Over? (Businessweek) see also A Fear Gauge Comes Up Short (WSJ)

• The cruelest month for gold (Market Watch)

• Why China is all that matters (MSN Money) see also How Fast Can China Go? (VF) and China as J.P. Morgan Might Have to Save World (Bloomberg)

• Rivals Scout Paulson Assets (WSJ)

• You can lever, but will you take the loss? (FT.com) the short answer: Take the Loss (TBP)

• A $50 Billion Claim of Havoc Looms for Bank of America (Deal Book)

• Don’t count on Markozy to save you as Greece falls (Market Watch) see also Tracking Europe’s Debt Crisis (NYT)

• Fisher Says Central Bank Is Under Attack From Ron Paul, Barney Frank (Bloomberg)

• Google will finance rooftop solar installations (LA Times)

• What Do Studebaker And Geocities Have In Common? No One Remembers Them (Fast Company)

What are you reading?

>

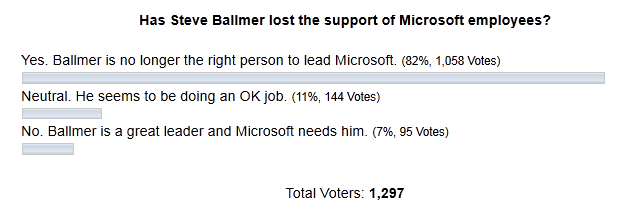

Poll: Should Microsoft CEO Steve Ballmer Go?

Source Seattle PI

What's been said:

Discussions found on the web: