Some interesting reading to start off your week:

• If It Looks Like a Bear, and Moves Like a Bear … (NYT) see also Pivot Point: Investors Lose Faith in Stocks (WSJ)

• Martin Wolf: What do the banks’ target returns on equity tell us? (FT.com)

• Volcker Rule May Lose Its Bite (WSJ) see also Volcker Rule May Extend to Overseas Banks (Bloomberg)

• The upside of economic worries: Lower gas prices (Associated Press)

• Thomas Friedman: Help Wanted: Leadership (NYT)

• JPM: Apple Trims Orders for iPad Parts (Bloomberg) see also The Bulls Pull Their Goalie (Reformed Broker)

• U.S. Household Worth Falls for First Time in Year (Bloomberg) see also Poverty pervades the suburbs (Yahoo Finance)

• Were Groupon’s and Overstock’s Management and Auditors Stupid or Did They Condone Improper Accounting Practices? (White Collar Fraud)

• Funk legend Sly Stone now homeless and living out of a van in LA (NY Post)

• CIA Says Global-Warming Intelligence Is ‘Classified’ (Wired)

What are you reading?

>

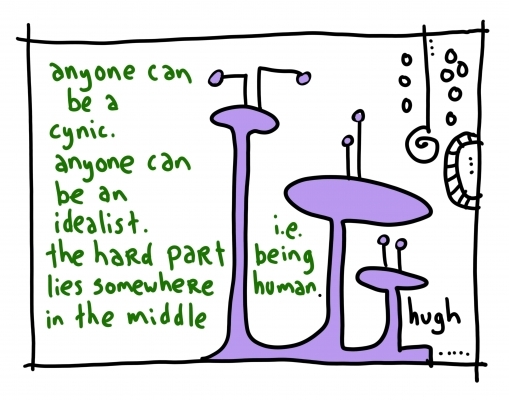

Source: Gapingvoid Gallery

What's been said:

Discussions found on the web: