(Source: Census.gov)>

If we were all to become suddenly rich tomorrow, the government’s revenue problems are solved at the current tax rates, so no worries in that case. But I place long odds on that, so let’s move on to what’s actually happening.

It’s as if the entire country has turned into Lake Wobegon, as if we’ve been overcome by an epidemic of illusory superiority. As I’ve watched the Republican debates, I’ve listened closely for the applause lines, paid close attention to the questions and answers. I also keenly read a variety of papers and occasionally watched Fox News.

My conclusion?

I am convinced that when President Obama mentions raising taxes on “the wealthiest Americans,” everyone thinks he is talking about them. I’m sure of it. I suppose I should be surprised, but when citizens admonish politicians to “Keep the government out of [their] Medicare,” I guess anything’s possible (like, say, an audience applauding the mere mention that Rick Perry has presided over more state-run executions than any governor in modern times).

Perhaps folks are thinking, “Well, my taxes might not go up now, since I’m making the median income, but my wages are going to quintuple any day now, I just know it. And when they do, I’ll be damned if I’m going to pay one more plug nickel in taxes. I also need to protect the loopholes for corporate jet owners, as I’ll surely soon be one.” Folks, can we have a reality check here? Pull out your most recent IRS Form 1040 and see exactly where you stand and whether or not you’re among the “wealthiest Americans” to which Obama has been referring. There is no doubt that some of you are, but I am equally sure that the vast majority of you are not, even if TBP may draw a somewhat higher income cohort. (As I read the comments to my recent post on the Census release (having already almost completed this post), I guess what I’m trying to say is summed up by Dogfish, who paraphrases Taibbi’s Griftopia: “”…tea party types like Joe the Plumber identify with the rich because they think “they are one clogged toilet away from being millionaires.”” News flash: they’re not.)

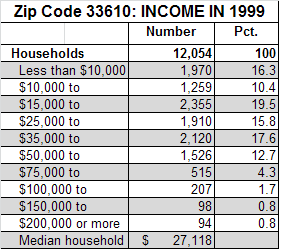

To quickly demonstrate the faulty thinking that must be at play here, let’s have a look at some economic statistics from the area in which Monday night’s debate took place. Specifically the zip code in which the Florida State Fairgrounds resides — 33610. Seems fair, since the audience was certainly enthusiastic enough about the slate of debaters and most definitely jazzed not to have their taxes raised. (With all credit to The Reformed Broker for his astute observation, it did seem as though most of the audience arrived at the Fairgrounds in their Medicare-funded Rascal Scooters.)

Unfortunately, the American Community Survey (ACS) covering the 2010 Census won’t be released until Sept. 22, so we’ll have no choice but to use data from the 2000 Census (I’ll make a note to revisit this data in a couple of weeks). So what do we learn about all those folks in 33610 (click through for Census fact sheet) who seem deathly afraid of having their taxes raised?

Give or take, it would seem there are probably just over 100 or so households (out of 12,000) that might see their taxes rise if some of what Obama proposes gets passes. All the others, not so much. We’ll have an updated number within the next two weeks, when the ACS is updated. So let’s get a collective grip here, splash some cold water on our faces, and have an understanding about what is being proposed and whom it’s going to impact.

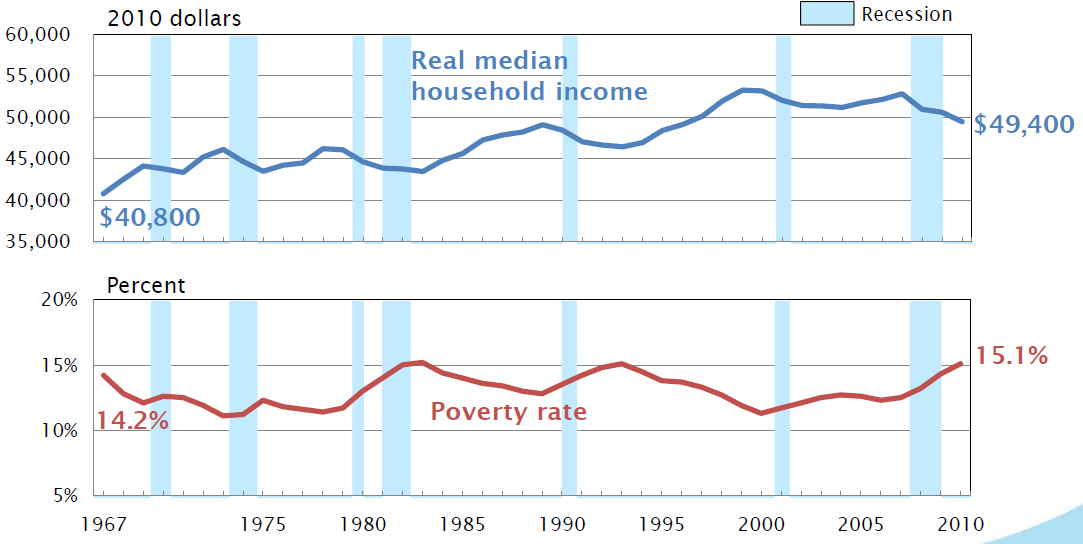

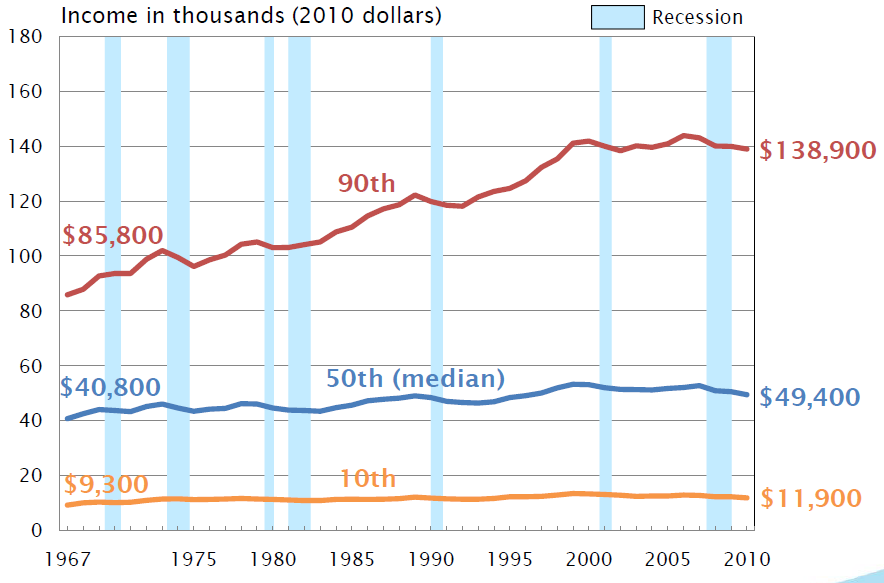

Having gotten that off my chest, below is another of the more distressing charts that appeared in the deck that accompanied the recent Census conference call on the Income/Poverty/Health Insurance release. Neither chart (at the top or immediately below) really needs much by way of explanation. It would be an understatement to call the trends disturbing.

~~~

~~~

Lastly, might as well get it out there that I’m making an effort to have a presence on Twitter. I’m @TBPInvictus if you’re interested; it’s almost exclusively economy and markets related. You’ll be wealthier for the follow.

What's been said:

Discussions found on the web: