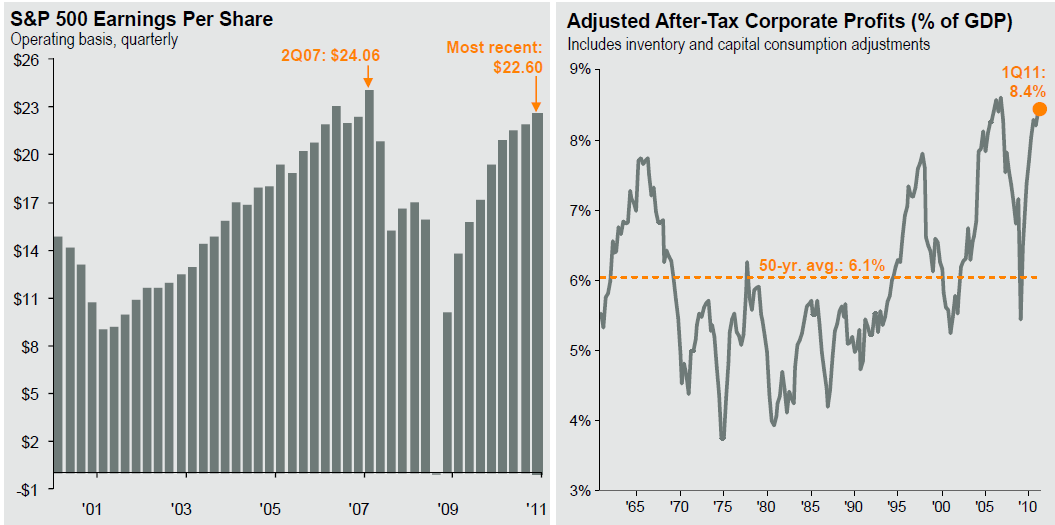

Peak corporate profits should lead, under normal circumstances, to more hiring and Capex spending. However, we are not seeing enough of either.

Will the corporate version of the Paradox of Thrift become a self-fulfilling prophesy?

>

Source: BLS, FactSet, J.P. Morgan Asset Management.

Data reflect most recently available as of 6/30/11.

Source: JP Morgan funds

What's been said:

Discussions found on the web: