>

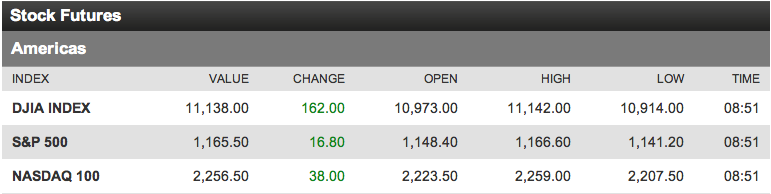

Following yesterday’s ugly intra-day reversal, the futures are looking strong, with the fair value on the Dow at ~200 in the green.

This is an oversold bear market bounce, and the odds favor its eventual exhaustion and reversal (there are internal metrics we can track which will help us identify if this run is the start of something more significant and lasting).

The usual rationales from pundits hold little water. Consider the explanatories we have heard this morning:

• Unemployment claims were not as bad as forecast — but do you expect any significant improvement in the employment picture over the next 3- 6 months?

• Bernanke’s Speech did not rule out further Fed action — despite his plea its up to Congress, the political pressure against him, and the ongoing attenuation of Fed action.

• European Greek Bailout is coming closer to fruition. Merkel got her votes, and it looks like some form of rescue / kick the can down the road / don’t Take the Loss is coming mid-October

• End of the Quarter is upon us, with all the attendant window dressing.

My keys for today — aside from atoning for my many sins — is to watch the breadth, the volume, and of course, be wary for any late day reversals. Watch the markets when Europe closes. Perhaps most of all, keep an eye on the news. Not the news itself, but see how markets react to new news — that is far more important.

This phase of the cycle is a trader’s market — not a buy & hold investor’s environment.

To the nimble go the spoils.

What's been said:

Discussions found on the web: