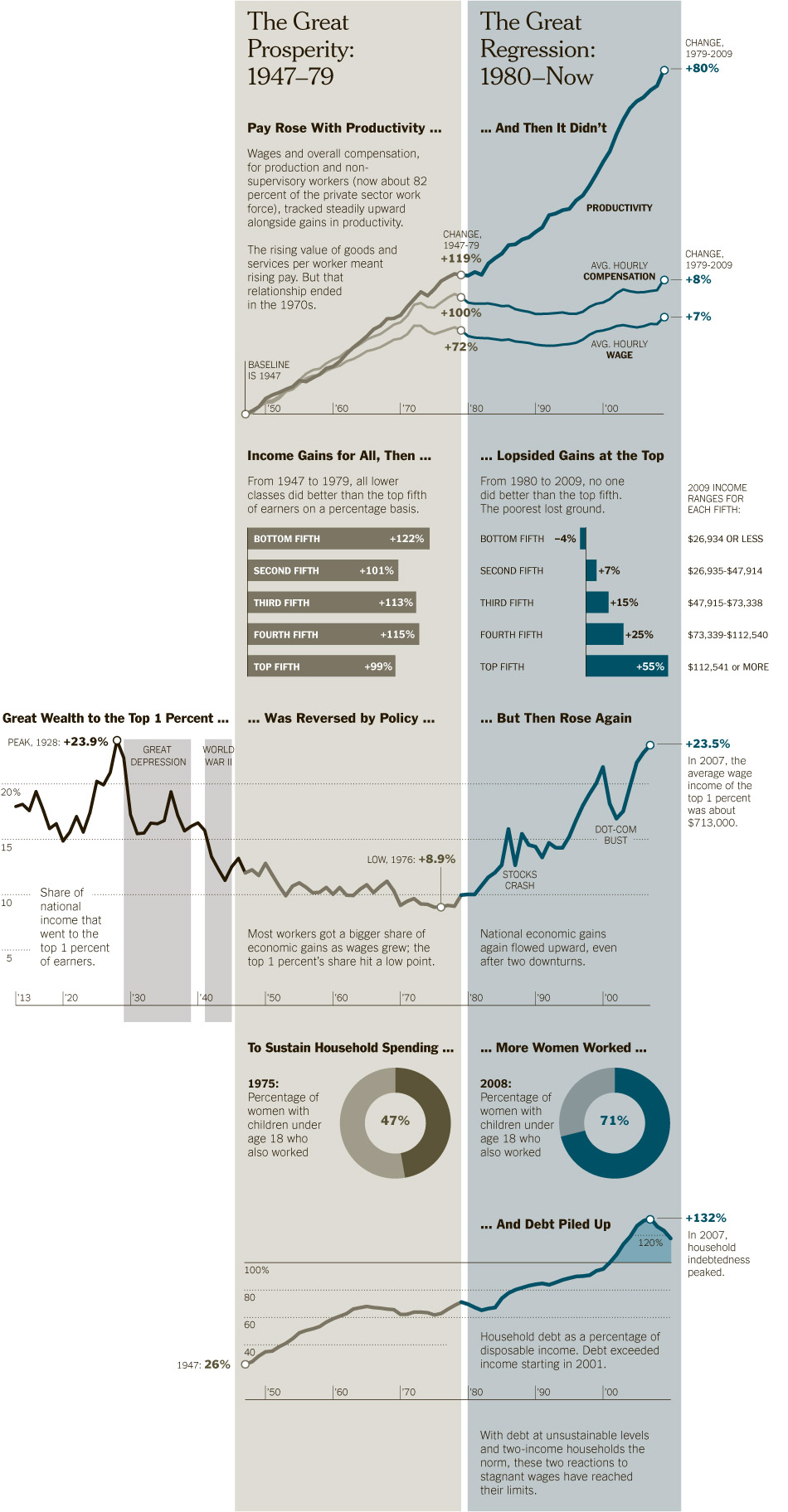

Monster chart porn, via Robert Reich in the Sunday NYT:

>

click for ginormous version:

>

Source:

The Limping Middle Class

ROBERT B. REICH

NYT, September 3, 2011

http://www.nytimes.com/2011/09/04/opinion/sunday/jobs-will-follow-a-strengthening-of-the-middle-class.html

What's been said:

Discussions found on the web: