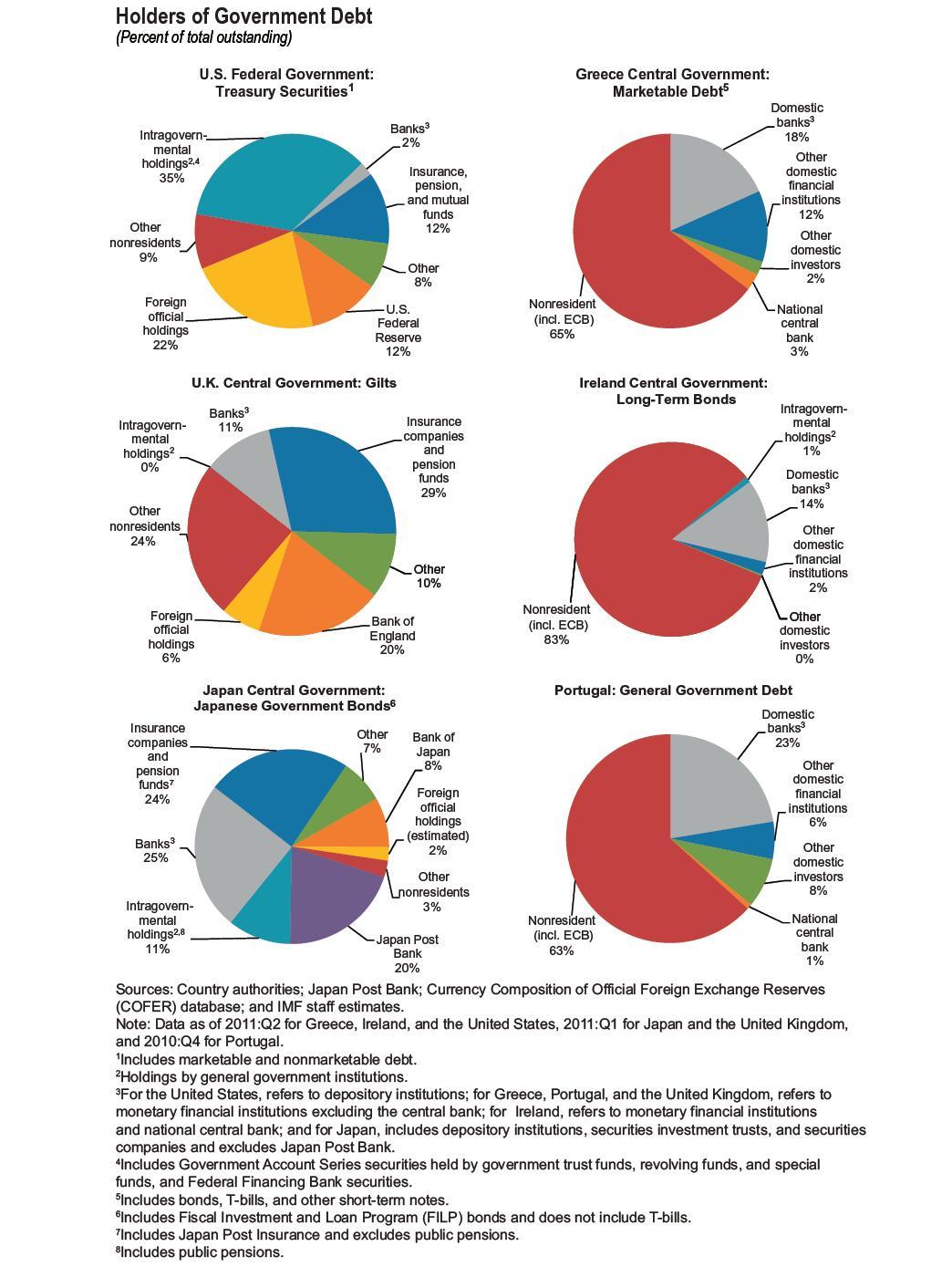

Here’s a great chart just released by the International Monetary Fund. Note that almost half — 47 percent – of the US$14.7 trillion U.S. federal government debt is held by the Federal Reserve and the government itself, such as the Social Security trust fund. Add to that the 22 percent foreign official holdings (mainly central banks) and almost 70 percent of the debt of the U.S. government is held by non-market/non-profit oriented investors. Stunning!

It’s also interesting to hear Europeans quote the $14.7 trillion (apx. 100% of GDP) figure while U.S. officials like to refer to marketable or debt held by the public, which totals US$10.1 trillion (apx. 75% of GDP). We’ll be back to you with more on this issue.

>

click on the chart to enlarge

What's been said:

Discussions found on the web: