>

Kevin Lane of FusionIQ writes:

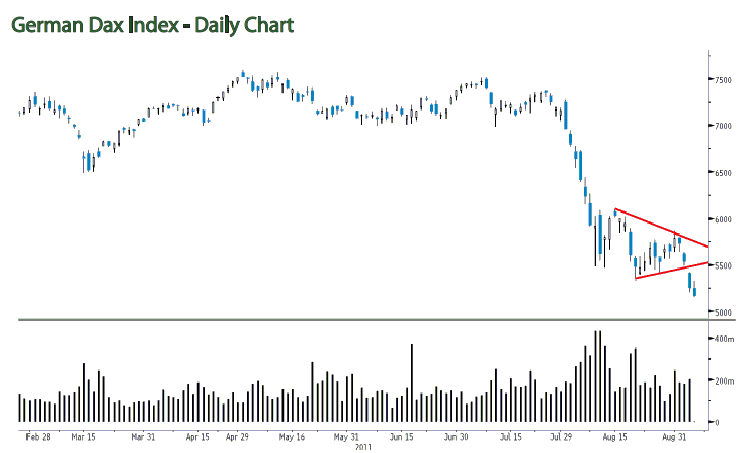

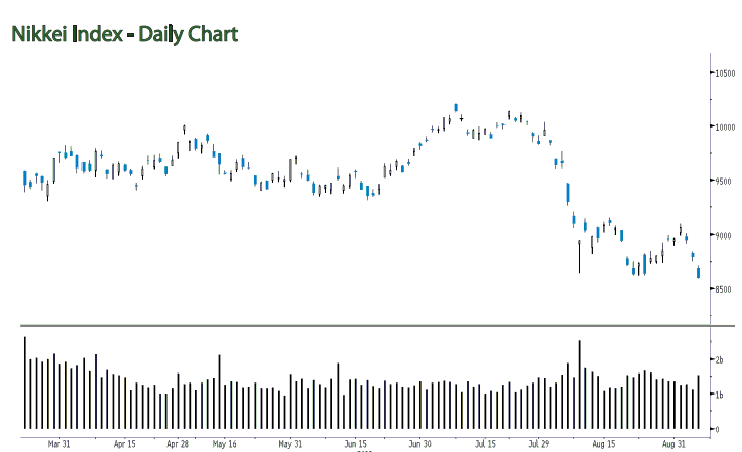

As seen in the attached pdf today we take a look at the German Dax, arguably the strongest and most stable economy in Europe. The DAX is currently at a six month low and not looking attractive technically. Additionally we take a look at the Nikkei and see it is also at new six month lows. Last but not least, we look at what we believe is the best real time bellwether for global economic activity, FedEx Corp (FDX) and it too is at a six month low.

Market breadth and trends globally remain poor as does confidence. Investors are not that far removed from the scars of 2008 so shooting first and asking questions later looks to be current mantra. While dislocation and panic create great opportunity, timing the end of these dislocations can be extremely tricky. That said it’s best to wait for real confirmation, even if it means missing a little bit of the turn.

Sentiment remains the markets only friend with negativity growing amongst investors, however sentiment is a mixed bag as this weekend strategist in Barron’s polled tended to still be extremely optimistic. Now we are not saying they are wrong but typically corrective waves end when people rein in their optimism. Again markets are formed on opinion and ultimately the correct one will surface and be backed by internals and volume. However at this juncture the path of least resistance remains down and until that chances it is better to be cautious than early !

Source:

IQ Global Equity Market Review, Sept 6th 2011