Source: Bianco Research

>

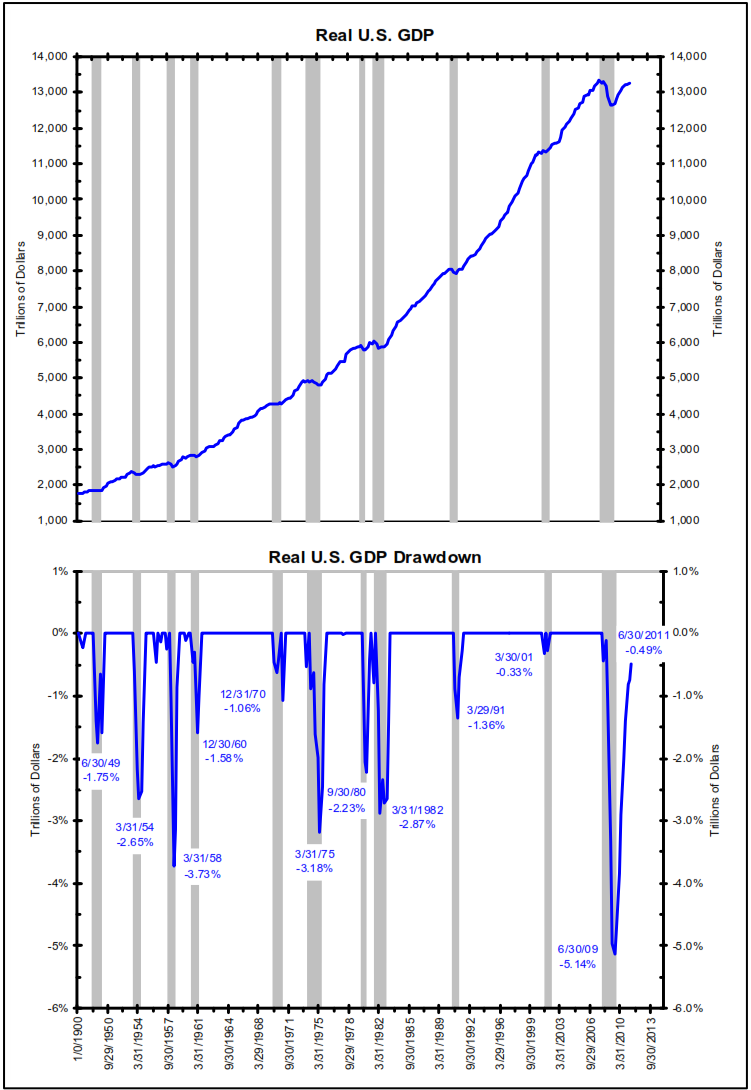

In the past we have noted that Martin Feldstein, one of the members of the business cycle dating committee, was the holdout in calling the end of the Great Recession. The committee works by consensus and Feldstein was not sure that the current economic expansion would make a new high. He relented and the Great Recession’s end was dated June 2009. The official call was made on September 20, 2010. For the moment, it looks like his first instincts were partially correct as a case can be made that the Great Recession never really ended.

The NBER has dated every recession back to 1854. A recession is a peak to trough in economic activity where the expansion off the trough results in a new high in real economic activity. This has been the case in every recession/depression/panic ever dated. Even the 1937 peak in economic activity (which began the 1937 recession) was above the 1929 peak (which started the Great Depression).

As the chart to the right shows, real GDP had its biggest fall since the end of WW2 (see the lower panel highlighting the drawdowns). More importantly, real GDP has made a new high in economic activity. If the economy continues to falter, then this is not a “double dip” but rather a continuation of the Great Recession. Now to be clear, the ultimate trough most likely already occurred in June 2009, which is how recessions are dated (peak to trough). However, the recession does not truly end until economic activity makes a new peak. For the moment, that has not happened. One could argue that August 2011 is the 44thmonth since the Great Recession began (December 2007). Only the Great Depression (which lasted 43 months from August 1929 to March 1933) and the Panic of 1873 (65 months from October 1873 to March 1879) took longer to make a new peak in economic activity.

What's been said:

Discussions found on the web: