I am not particularly bullish these days — 50/50 stocks versus cash/bonds — and while we certainly could see a bounce up towards the 1250 level on the SPX, I am not sanguine about the next 2Qs of market performance.

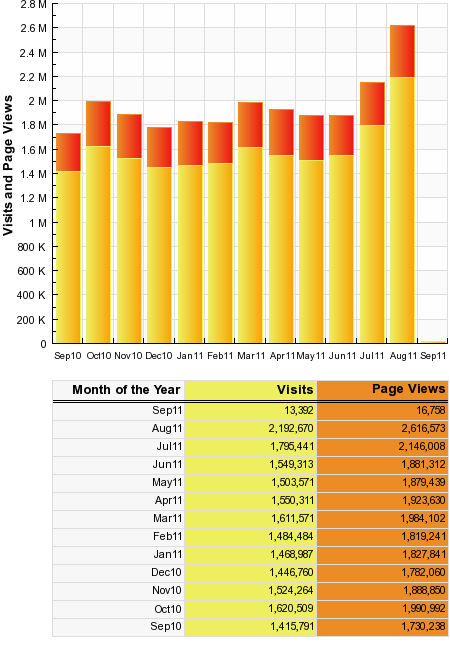

That said, the chart below may be a very short term, bullish indicator. As we have seen in the past, TBP traffic spikes are often accompany a substantial increase in nervousness. That can set the table for a decent bounce, but as the dates below confirm, it is typically short term in nature. More solid bottoms (i.e., 2 years versus 2 months) were more likely to be accompanied by complacency, not interest.

>

via Site Meter

>

Previously:

Blog Traffic Reading: Complacent! (April 30th, 2009)

Blog Traffic as a Contrary Market Indicator (February 4th, 2008)

Traffic Indicates . . . (June 21st, 2008)

Traffic Peaked Again Near Short Term Bottom (July 18th, 2008)

Crazy Fannie/Freddie Traffic Spike! (September 8th, 2008)

What's been said:

Discussions found on the web: