The cover story in Barron’s looks at some of the usual denizen’s of the Street’s biggest shops. They are, as is their wont, bullish and long and not particularly concerned about a recession (Its priced in!) or another leg down in Housing (its cheap!) or the market’s technical signals (we’re finding a bottom!) or deleveraging (sorry, the term is not familiar).

Most see the “economic data stabilizing and then improve instead of worsening“. If they are wrong, they perceive the downside risk to (WTF?) all of SPX 1,000. The Bear in the group is Douglas Cliggott, Credit Suisse’s U.S. equity strategist. He lowered his year-end S&P target to 1100 –less than 7% from Friday’s close (it was at 1275). Strategas’s Jason Trennert correctly notes the major indexes’ moving averages have broken down. Even he sees only a 35% probability of a recession next year, and a flat finish (SPX 1165) at year end from here.

My issue is not whether these gentlemen are right — perhaps they are — or wrong — which they frequently can be.

Rather, its that their (or their client’s) enormous assets under management (AUM). It prevents them from being anything other than Long & Strong & often Wrong (the club to which they Belong). They may have a methodology, but it doesn’t really allow much other than Buy & Hold, which is all you can do with $100s of billions or even trillions in AUM. Its a rare strategist who can manage risk or protect capital; Forget beating the market — they ARE the market.

Hence, a bullish bias is built into their views. That serves them well during secular bull markets (i.e., 1982-2000) but its punishing during secular bear markets (1966-82; 2000-present).

>

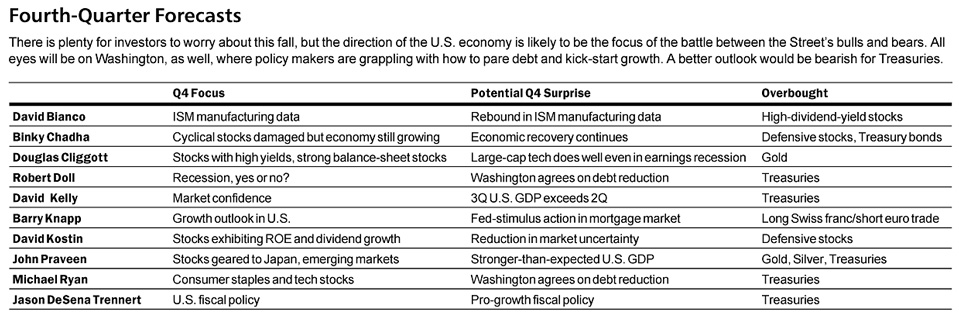

Click for forecasts from Wall Street Strategists

Source: Barron’s

>

Source:

Which Way Up?

VITO J. RACANELLI

Barron’s September 3, 2011

http://online.barrons.com/article/SB50001424052702303544204576542623047983688.html

What's been said:

Discussions found on the web: