These are the most interesting items I came across today:

• Farell: A new Lost Decade is leading to revolution (Marketwatch) see also On Wall Street, a Protest Matures (Deal Book)

• Pomboy: Straight talk from a market contrarian (Fortune)

• Nocera: Why the US (like China) Must Commercialize Energy Technologies (NYT) see also A Waste Of Energy? (New Yorker)

• Bruce Bartlett: Misrepresentations, Regulations and Jobs (Economix)

• A ‘Robin Hood’ tax is no way to redistribute (Tim Harford) see also A Hard Rain’s Gonna Fall (Epicurean Dealmaker)

• Walker Todd: Obama’s Lost Opportunities (Institutional Risk Analytics)

• The Roller Coaster Ride Continues for Madoff Investors (Deal Book)

• Google Joins Apple in Push for Tax Holiday (Bloomberg)

• Drunken parrot season begins in Darwin (Australian Geographic)

What are you reading?

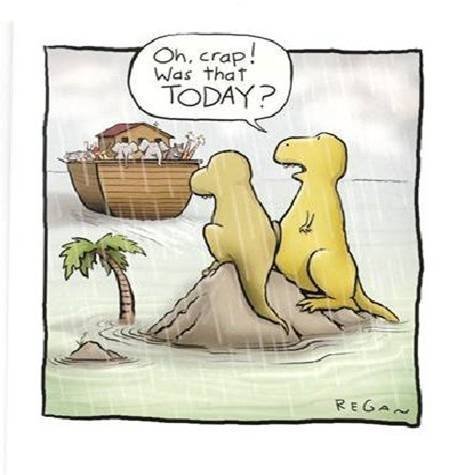

Traders on the Long Side forget to hedge their positions . . .

What's been said:

Discussions found on the web: