If I could get one question posed to the candidates at the next debate (Tuesday night), which is to focus solely on the economy, it would be this:

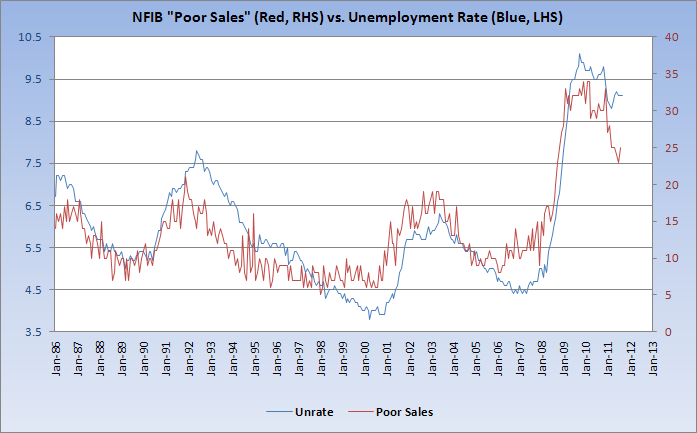

“We repeatedly hear about taxes, regulations, and uncertainty standing in the way of job creation. However, the National Federation of Independent Business (“The Voice of Small Business”) surveys its members every month as to their “Single Biggest Problem.” Among the possible answers are both taxes and regulations, yet “Poor Sales” has, in fact, dominated for the past three years. Additionally, as we see in the chart, “Poor Sales” and the Unemployment Rate correlate very strongly, at about 0.87.

Given these facts, is it disputable that our problem is one of aggregate demand and that, if we could improve demand we could lower the unemployment rate notwithstanding the tax or regulatory environment?”

>

Drop your own (serious, well-formulated) questions in comments and hopefully we might get one or two plucked for inclusion in the debate.

(Catch up with me @TBPInvictus)

Update (10/9 @ 3:20 ET): I have a critic here at Cafe Hayek. Not sure yet whether to append a response here, over there, or make it another post entirely. Thanks to Pantmaker and Jojo for the additional commentary here and here; had just about forgotten those citations. I will ping Russ Roberts, my critic, to make him aware of them.

What's been said:

Discussions found on the web: