Paul Brodsky & Lee Quaintance run QB Partners, a private macro-oriented investment fund based in New York.

~~~

The protesters on Wall Street shouldn’t be patronized. Though they may not be financial sophisticates and they don’t know how to articulate a coherent message, they are absolutely – unquestionably – intuitively correct in directing their protest against the banking system.

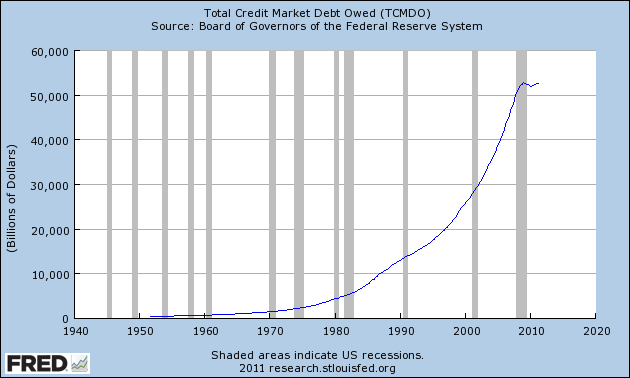

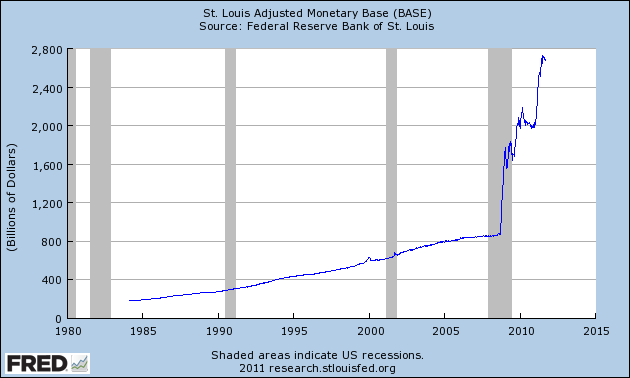

Conceptually and now practically, a fractionally-reserved lending system combined with an uncollateralized currency allows governments, central banks and private banks to issue infinite credit to themselves. Briefly, credit/debt is “when-issued” money; a dollar of credit today demands the creation of a dollar tomorrow. According to the Fed there is currently about $53 trillion in outstanding dollar-denominated claims and only $2.7 trillion (after QE2) of base money (M0, or bank reserves held at the Fed and currency in circulation). In other words, the entire US monetary system remains levered about 20 to 1. Put another way, there is about $53 trillion in debt and not quite $3 trillion with which to repay it.

Please notice the scale on the left axes of the two graphs below:

Further, term-credit provided to homeowners and other holders of long-term debt obligations is mismatched — funded in the public sector through future tax receipts (further and further into the future), and funded in the private sector through overnight repurchase agreements, commercial paper, checking accounts, demand deposits and passive pension fund bond allocations. So then we have very leveraged economies funded virtually overnight by our central banks. This is the point of criticality on which our real economies rely.

So it’s easy to understand how and why our economies have become so leveraged. But why are protesters starting to gather?

A wage earner – whether he or she self-identifies as progressive or conservative – can no longer save his or her wage and hope to keep his or her purchasing power. Why? Because more money has to be created simply to service already outstanding debt. As the Fed has created more money since 2008, (and given the vast majority of it to creditor banks, not debtors), the purchasing power of a wage-earner’s dollar has diminished in terms of food, energy and other goods and services that do not require credit for consumption (i.e. nominal prices are rising at the supermarket and gas pump but home prices are falling). This is perfectly logical.

The real economy is now naturally compelled to de-lever. There are only two ways to de-lever: 1) let credit naturally deteriorate, or 2) print money. The numerator (debt) and denominator (base money) must be reduced. Money creation is far more socially and politically expedient because debt deterioration would mean rising unemployment and bankruptcies, not to mention bank asset deterioration. Money printing, on the other hand, promises to ease the burden of repaying private sector debt loads ONLY IF the new money reaches private sector debtors. So far the new money has only gone to the banking system.

There is a far more fundamental aspect to the workings of our monetary system that is also clearly inequitable. Our markets and economy are no longer producing capital (sustainable wealth and resources). Leverage has marginalized real growth. Further asset price increases can only be catalyzed by further credit or money growth – enough to turn de-leveraging into re-leveraging. A growing percentage of people in Europe and the US are discovering that the economy in which they are ostensibly participating has been serving at the pleasure of a very small class of professional leveragers. What protesters seem to intuit is that the banking system has all the power and that it is taking care of its own.

For those of you who self-identify as progressives, you should re-think your defense of the current system. Money printing is a terribly regressive tax on the working and middle classes. Those with higher incomes and access to credit remain able to maintain their demand for inelastic goods and services, as well as maintain their ability to service debts, while lower wage earners, those with less access to credit, and those losing jobs as the real economy shrinks, are suffering. For those of you who self-identify as “free-market conservatives”, you should also re-think your support of the current system. “Free markets” are compelled to de-leverage presently, not to re-leverage. A more laissez faire regulatory environment and lower taxes do not address the fundamental problem, which is an abundance of credit that re-distributes wealth from the factors of production to the leveragers.

So…this humble fund manager doesn’t get the displayed ignorance of the financial press when it comes to linking the incentives of various constituencies – banks, policy makers, employers, investors, Occupy Wall Street, the Tea Party and, it must be acknowledged, the established media itself. Judging purely as an outsider and at the risk of oversimplifying, it seems that Wall Street, Washington, investors and established media are on one side while the real economy and “fringe movements” are on the other. What the establishment doesn’t seem to get is that the “fringe” is a burgeoning growth industry with moral clarity on its side. So, it seems to me the kids downtown are credible and the “vocal fringe” is actually representing a disenfranchised majority that is quickly growing disenchanted with “reasonable centrism”.

Don’t trust me. Find the smartest non-partisan academic historians, sociologists, economists and philosophers in your rolodex and ask them to help connect the dots. Then ask bank economists, market strategists, partisan think-tanks, policy makers and financiers. I think it’s wise to bet with the findings of the former group because the self-selected latter group’s can’t, by definition, see change.

What's been said:

Discussions found on the web: