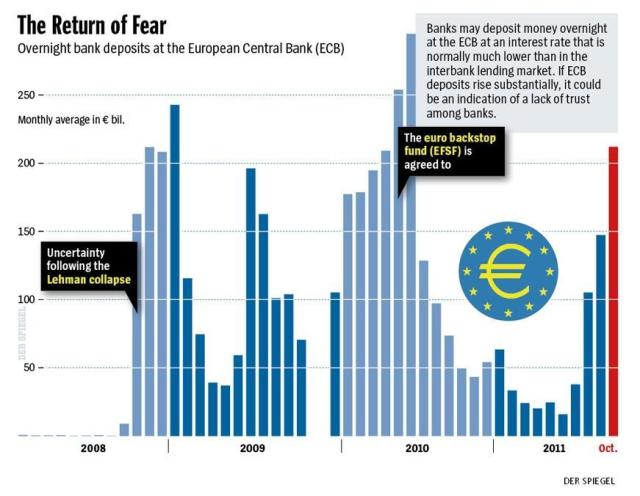

The Wall Street Journal reports Euro-zone banks’ overnight deposits at the ECB increased again last week “reflecting deepening distrust in interbank lending markets.” The Journal writes,

Overnight deposits Friday rose to €255.57 billion ($341.88 billion), surpassing Thursday’s 2011 high of more than €229 billion.

The focus of the sovereign crisis in recent days and weeks has shifted to concerns about the health of the euro zone’s banks, reflected in large part by the poorly functioning funding markets…

Aside from market tensions, overnight deposits tend to rise towards the end of the ECB’s reserve period, which is Tuesday, as banks store excess liquidity in the facility after meeting their own reserve requirements for the month.

The ECB’s all-time overnight deposit high of €384.3 billion was reached in June 2010, driven by uncertainty about the then nascent debt crisis and an abundance of liquidity in the market as banks prepared to repay a 12-month ECB refinancing operation.

(click here if chart is not observable)

(click here if chart is not observable)

What's been said:

Discussions found on the web: