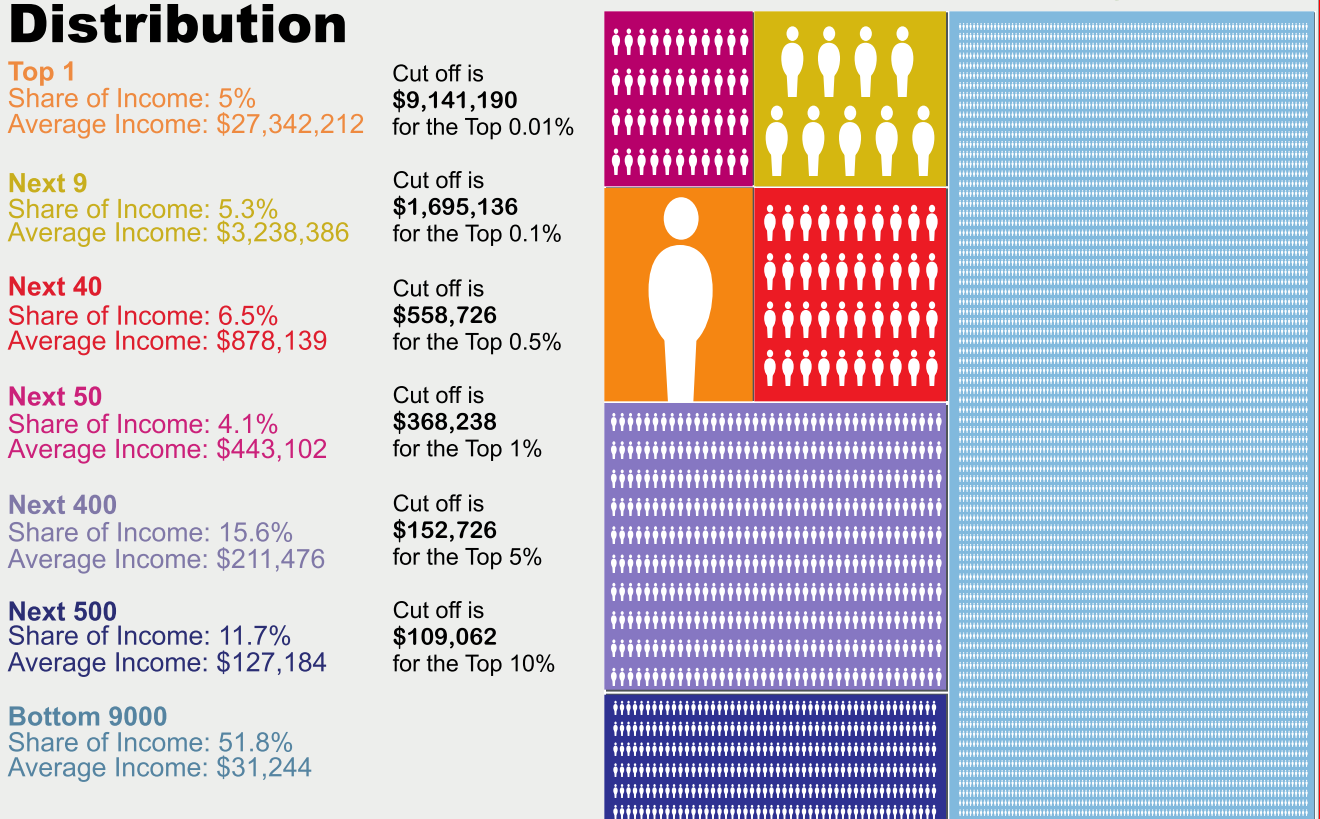

Just today, I overheard someone say that income inequality must not be that bad, because you only need a few $100,000 to be in the 99th percentile (see CNN/Money) — that works out to be about $343k to make the top 1%.

That is factually accurate, but misses the full wealth disparity issue. To see where the big bucks are, you need to look into the top 0.5%, 0.1%, 0.01% and lastly, and lastly, the top 0.001%.

The details of this were delightfully illustrated by Catherine Mulbrandon at TBP conference – PDF presentation here, video here.

Top 1% = $368,238 (20.9% of income)

Top 0.5% = $558,726 (16.8% of income)

Top 0.1% = $1,695,136 (10.3% of income)

Top 0.01% = $9,141,190 (5% of income)

>

click for larger chart

What's been said:

Discussions found on the web: