Some morning reads to end your week with:

• 3 reasons why the EU wants rating agencies to shut op for a while (Econo Shock) see also European debt crisis talks plunged into chaos as leaders announce another summit (Telegraph)

• Consumers Most Negative Since Recession (Bloomberg)

• Could ‘Twist’ Really Be Working? (WSJ) but see Fed Told Us 2012 Economy is Ugly (Alhambra)

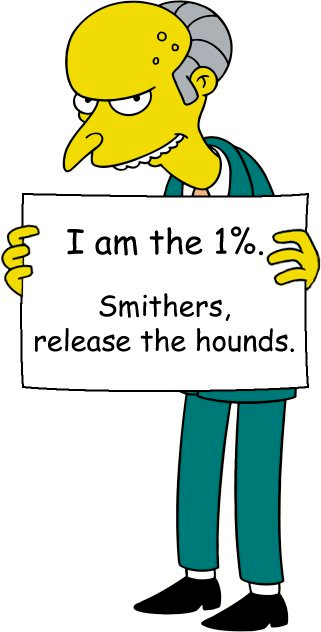

• Millionaires Control 39% of Global Wealth (WSJ)

• M.B.A.s Seek to Occupy Wall Street (WSJ) see also Advisers split on Occupy Wall Street (Investment News)

• Steve Jobs Threatened ‘Thermonuclear War’ on Google (Bloomberg)

• New Politics: Secret Cash Baiting Officials Leaves No Trace in U.S. Attack Ads (Bloomberg) see also Price of Power: Congressional Leadership Positions for Sale to the Highest Bidder (AlterNet)

• Dropbox Will Simplify Your Life (NYT)

• The “Last Place Aversion” Paradox (Scientific American) see also Why We Can’t Let Go of Our Losers (WSJ)

What are you reading?

>

What's been said:

Discussions found on the web: