What does it say about the state of our exchanges that trader on proprietary and execution desks now can buy a software program to alert them to the activities of Co-Located Algo Servers?

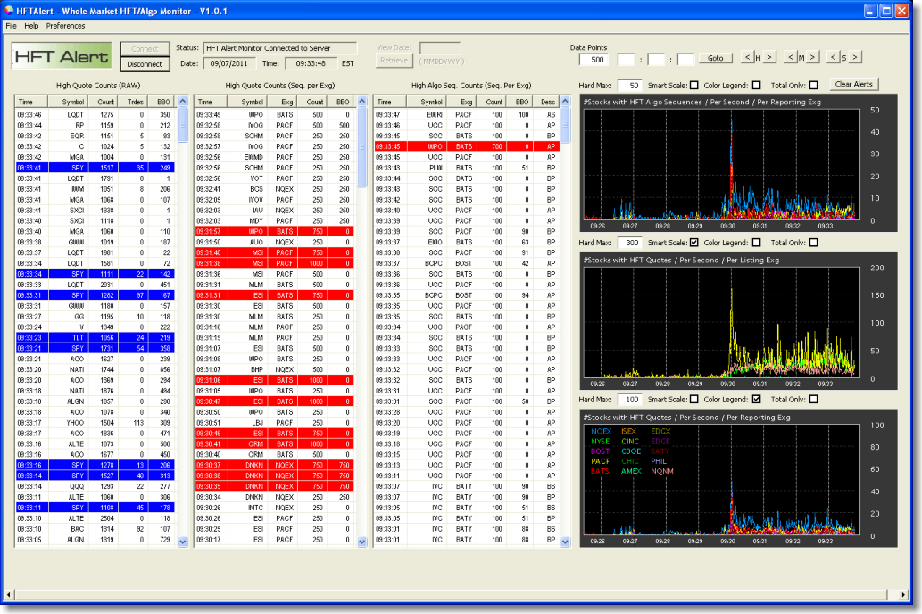

“HFT Alert, the first real time software designed to detect high frequency and algorithmic trading systems. HFT Alert identifies when these trading systems are running and what stocks are being affected. HFT Alert can detect several types of algorithms as well as stocks experiencing elevated quote rates associated with algorithmic trading.”

We are now apparently in a silicon based arms race to learn when quotes are real and when they are spoofed faux quotes driven by HFT algos designed to increase volatility.

The exchanges once operated fro the greater good of the investing public, akin to nonprofit utilities. They are now hellbent on chasing away private investors who will eventually learn that this is a zero sum game, and co-located HFTs are a tax on saving and investments . . .

Video here; Descriptions here, press release here.

>

What's been said:

Discussions found on the web: