>

Stock investors may take days to distinguish real news from noise, according to Federal Reserve Bank of New York.

This is especially true these days, given false announcements of bailouts, Fed interventions and rescues. They tend to cause fake short squeezes that temporarily spike markets, only to see them ultimately head lower.

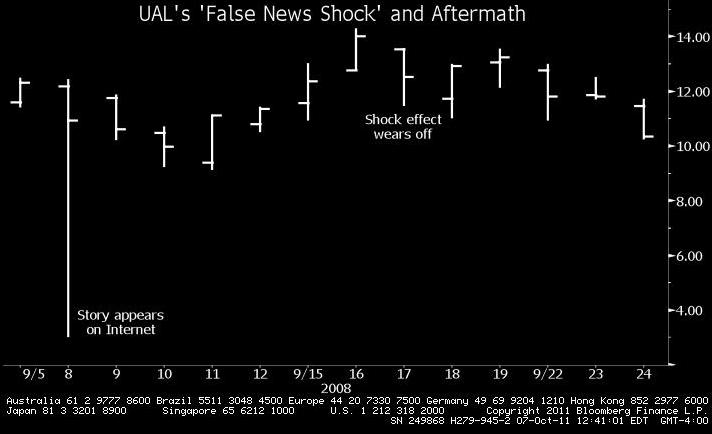

To get a closer look of noise on markets, the FFRBNY studied how UAL’s stock moved in September 2008. At the time, a “six-year-old report on the company’s bankruptcy filing appeared online and was treated as a new story.”

David Wilson of Bloomberg has the details:

“UAL, which later became United Continental Holdings Inc., plunged as much as 76 percent on Sept. 8, 2008, in response to the error. While UAL’s loss narrowed to 11 percent by the close of trading, the shares fell the next two days before rebounding.

“Residual effects attributable to the false news shock” lasted for seven trading days, the researchers wrote this week in a blog posting on the New York Fed’s website. The effect is at odds with the efficient-market hypothesis, which holds that share prices reflect all publicly available data on a company.

To identify the time period, they estimated where UAL’s shares would have traded if the outdated report hadn’t surfaced. The projection was derived from the performance of the Standard & Poor’s 500 Index, the Bloomberg World Airlines Index and crude oil during the period. The posting by economists Carlos Carvalho, Nicholas Klagge and Emanuel Moench was based on a report they published in May 2009 and revised in June. Carvalho, who teaches economics at the Pontifical Catholic University of Rio de Janeiro, worked at the New York Fed when the research was originally done. His two co- authors are still there.

Given every twitch of the market over tales of EU/ECB action, German banks bailing out Italy, or anything related to Greece, it is interesting to see how traders behave relative to false announcements.

What's been said:

Discussions found on the web: