Some reading material to stimulate your brains and start off your weekend:

• Contrary Opinion: Wall of worry gives way to slope of hope (Market Watch)

• Ray Dalio’s radical truth (Institutional Investor)

• More 401(k) Plans, IRAs May Offer Investing Advice (Yahoo Finance)

• The past decade GDP was driven solely by Credit (NYT)

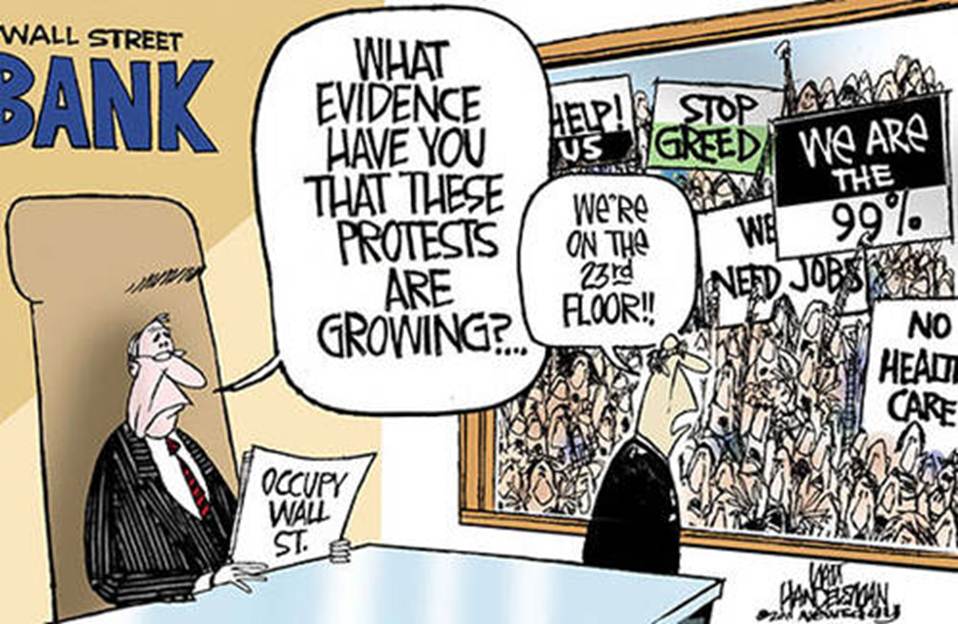

• Occupy Wall Street: It’s Not a Hippie Thing (Businessweek) see also Nothing’s More American than Fighting Greedy Bankers (Tyee)

• European Bank Debt-Guarantee Proposals May Struggle to Thaw Funding Market (Bloomberg)

• Why do we need a financial sector? (Vox) see also Big Banks Blink on New Card Fees (WSJ)

• Mark Thoma on Econometrics (Browser)

• The Hellhound of Wall Street: How Ferdinand Pecora’s Investigation of the Great Crash Forever Changed American Finance (EH.net)

• The Ideological Fantasies of Inequality Deniers (NY Mag)

>

What's been said:

Discussions found on the web: