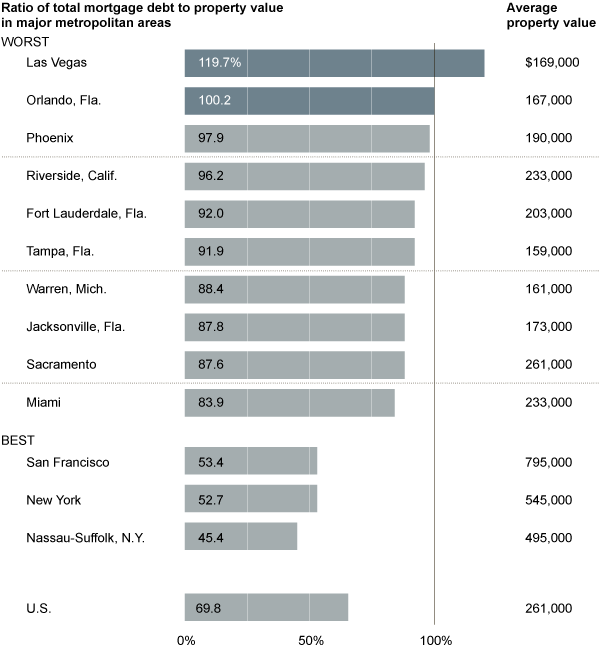

As the housing market collapsed and home prices plummeted, Americans lost vast amounts of wealth. Homeowners in some cities were hit particularly hard — Las Vegas and Orlando, Fla., are now effectively “underwater,” with more mortgage debt than property value over all.

>

Source:

Gloom Grips Consumers, and It May Be Home Prices

NYT, October 18, 2011

What's been said:

Discussions found on the web: