Intervention Rally: Good, Bad or Ugly?

At times, I have described Good News as Bad — meaning that is could encourage the Fed withdrawing its accommodation, raising rates,...

My afternoon train reading on this day when stocks had their biggest rally since March 2009: • Central Bank Intervention Round Up:...

My afternoon train reading on this day when stocks had their biggest rally since March 2009: • Central Bank Intervention Round Up:...

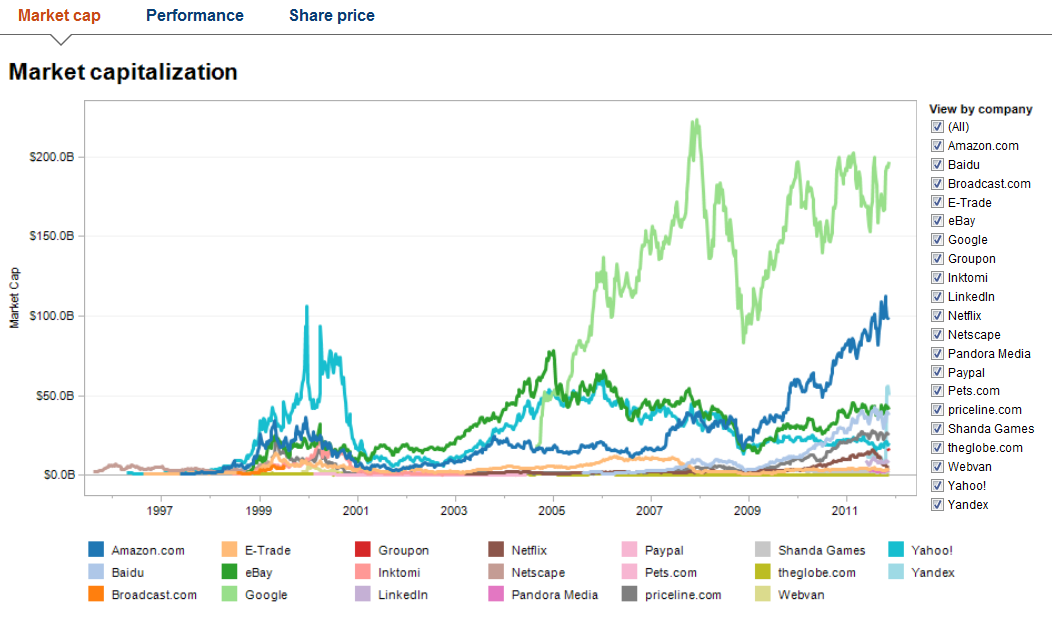

Interesting chart via the WSJ about IPOS — which often capture the public’s attention, despite their being less than reliable...

Interesting chart via the WSJ about IPOS — which often capture the public’s attention, despite their being less than reliable...

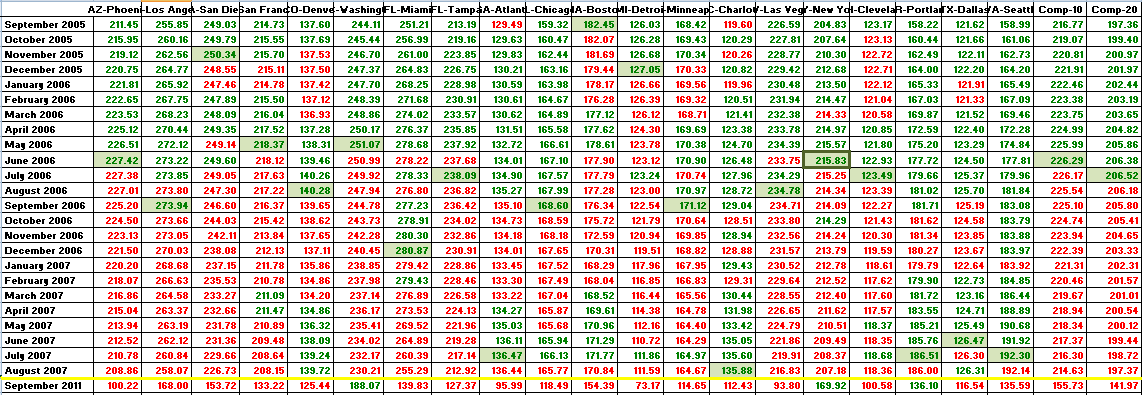

“It’s a little known fact,” as Cliff Clavin would tell us, “that the first city to have its housing bubble burst...

“It’s a little known fact,” as Cliff Clavin would tell us, “that the first city to have its housing bubble burst...

Get subscriber-only insights and news delivered by Barry every two weeks.