This lovely Friday’s end of week reading:

• Banking Systems Most Exposed to PIIGS Nations – 3,2 trillion USD (Asymptotix) see also Everything you need to know about the European debt crisis in one post (Washington Post)

• Volcker on the Unfinished Business Financial Reform: (NY Review of Books)

• Moral Hazard? Does MFGlobal Demise Show U.S. Willing to Let Bigger Firms Fail? (Bloomberg)

• Slowpoke Traders Seek to Gain on Speedsters (WSJ)

• The MF Global fun never stops:

…..-Masked Debt Risks (WSJ)

…..-As Regulators Pressed Changes, Corzine Pushed Back, and Won (DealBook)

• Dividend Swaps Signal No Slowdown as European Crisis Boils (Bloomberg)

• Groupon’s No Bargain (The Daily Beast)

• Artificial stupidity: Siri suffers a 5-hour outage (Fortune)

• Eejits: ‘Journalists all use Wikipedia’ (Poynter)

• The Big List of Behavioral Biases (Psy-Fi Blog)

What are you reading?

>

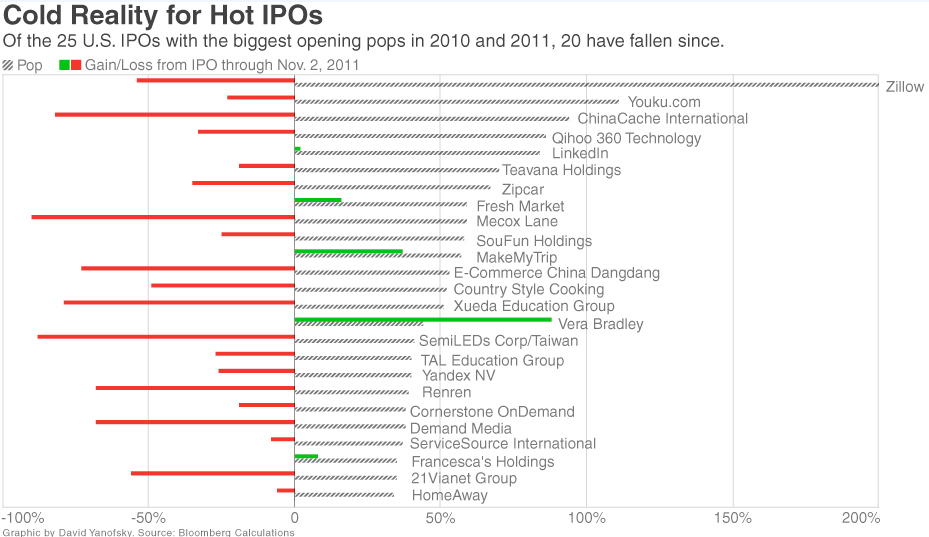

Source : BusinessWeek

What's been said:

Discussions found on the web: