Michael A. Gayed, CFA is Chief Investment Strategist at Pension Partners LLC, where he structures portfolios. In 2007, he launched his own long/short hedge fund, using various trading strategies focused on taking advantage of stock market anomalies. Michael earned his B.S. from New York University, and is a CFA Charterholder.

~~~

One of the most glaring disconnects that continues to persist this year is the optimism of equities relative to the depressed bond market. I call the bond market depressed because yields on U.S. Treasuries are at levels that one should not see unless headed into a contractionary and potentially deflationary economic cycle. The reasoning behind such low yields is a function of slow growth in the U.S. and of course continued upheavel and concern over Europe. Despite the fact that the bond market is generally more right more often than the stock market, equities, as proxied by the S&P 500, have actually held up relatively well all year despite massive day to day swings.

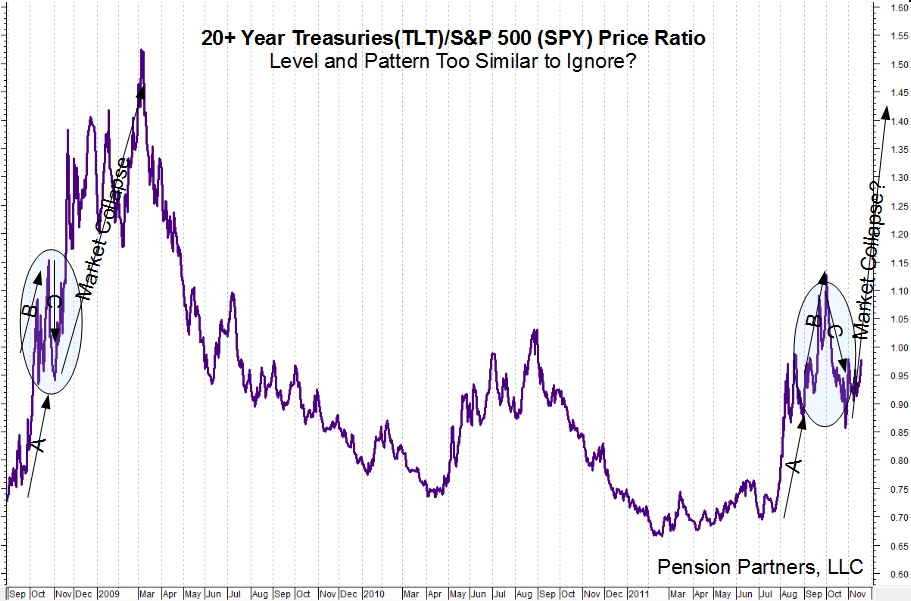

Rather than look at the bond and stock market in isolation, its important to look at their relationship to each other to see if there is a conscious or unconscious message investors are sending. To that end, take a look below at the price ratio of the 20+ Year Treasury Bond ETF (TLT) relative to the S&P 500 (SPY). As a reminder, a rising price ratio means the numerator/TLT is outperforming (up more/down less) the denominator/SPY.

When the trend of the price ratio is up, it means bonds are outperforming equities. This generally only happens in recessions/deflationary enviornments as fixed income becomes more valuable than equities. The opposite occurs in a downtrend (equities perform better than bonds when the enviornment favors growth/increased inflation).

I have annotated the chart to stress that both the level and pattern of the price ratio is reminiscent of the latter part of 2008 post-Lehman as the credit seize up took hold of financial markets. Is the intermarket relationship of bonds/stocks foretelling a repeat of 2008 is imminent? Note that if the TLT/SPY ratio spikes as it did into the March 2009 low, it likely would be driven largely by a shrinking denominator (stock market declines) – suggesting that the bond market’s perceived paranoia about the future may indeed be correct. And because the stock market tends to act with a lag, we may be headed for a December to Remember…

What do you think?

What's been said:

Discussions found on the web: