Yesterday, we took a global view of the Housing boom & bust; Today, we take a somewhat wonkier view of Home construction’s contribution to Employment Growth and GDP in Europe.

As the charts from then Federal Reserve Bank of St. Louis below show, the construction boom was global. It occurred in countries that have home mortgage deductions and those that didn’t; those whose governments have home ownership targets and those that did not.

The one consistent causal element in ALL of these nations was the Community Reinvestment Act, Barney Frank, Fannie & Freddie Ultra low interest rates had made the cost of buying a home much cheaper, and helped set off a boom in prices.

>

~~~

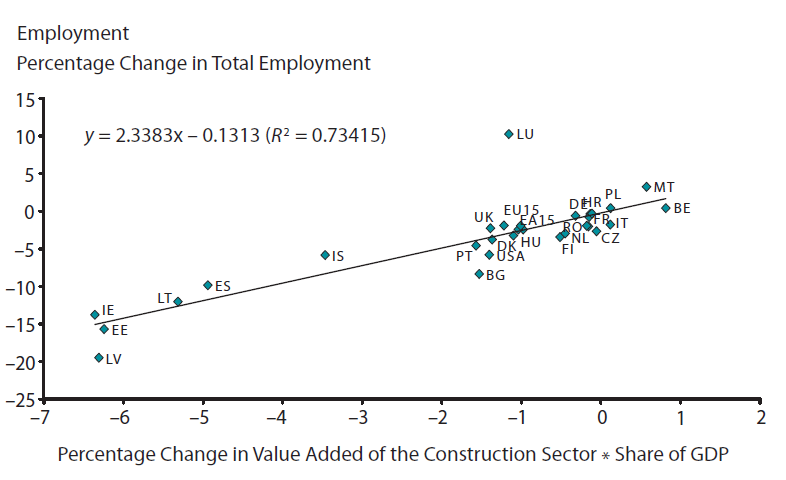

Source: Economic Synopses Construction and the Great Recession

2011, Number 35

What's been said:

Discussions found on the web: