>

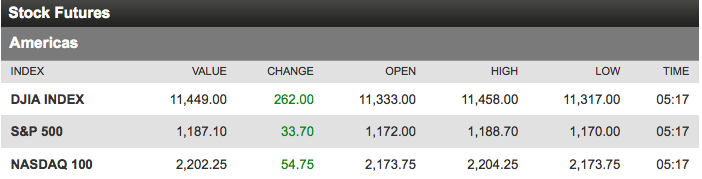

Futures are screaming higher overnight on yet another European bailout deal for Italy.

According to unverified reports from La Stampa, the IMF is preparing a 600 billion euro ($794 billion) loan for Italy. The paper has refused to state where it got the information. (IMF denied this to Reuters)

But that small detail is of no consequence to traders hungry for some green on the screen after November saw $4.7 trillion wiped out from global equity values. If we were to open here, markets would gap up nearly 2%, breaking a seven-day losing streak for US equities. Asian stocks have already broken their 4 day losing streak, with the MSCI Asia Pacific Index gaining 1.3%.

A few caveats:

The bailout rumors are just that — rumors. Note that the U.S. is a major funder of the IMF, and a bailout of Italy with US Taxpayer dollars wont go over well in an election year.

Also note that the reporting on sales during Thanksgiving was filled with all manner of garbage (Sales climbed “16 percent to a record, said the National Retail Federation”) I suspect we will see flat to 2% sales gains at best, and not these ridiculous outliers.

Regardless, don’t forget to bring your rally caps to work tomorrow. . .

~~~

UPDATE: November 28, 2011 5:12am

IMF is denying the report in statements (Reuters)

What's been said:

Discussions found on the web: