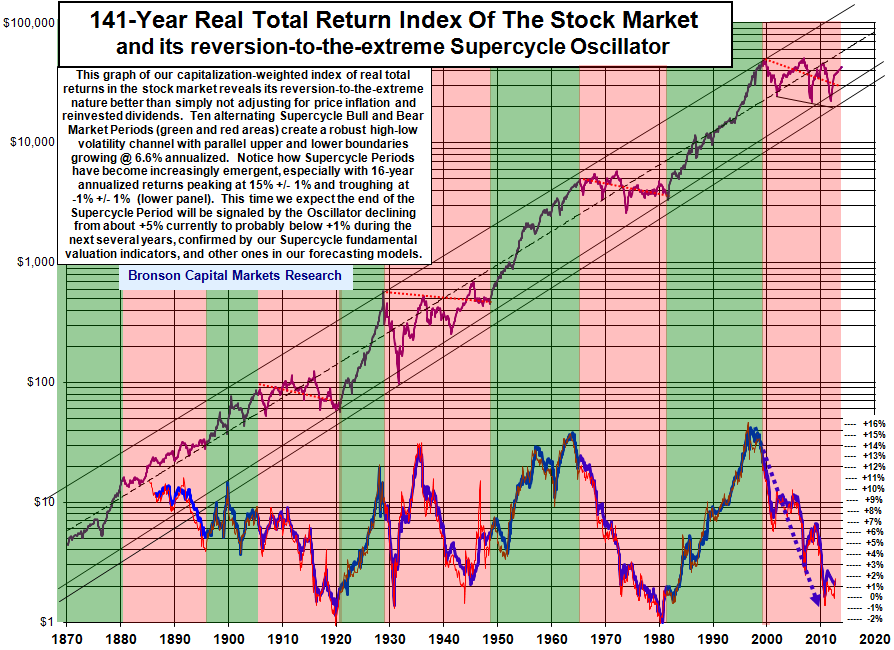

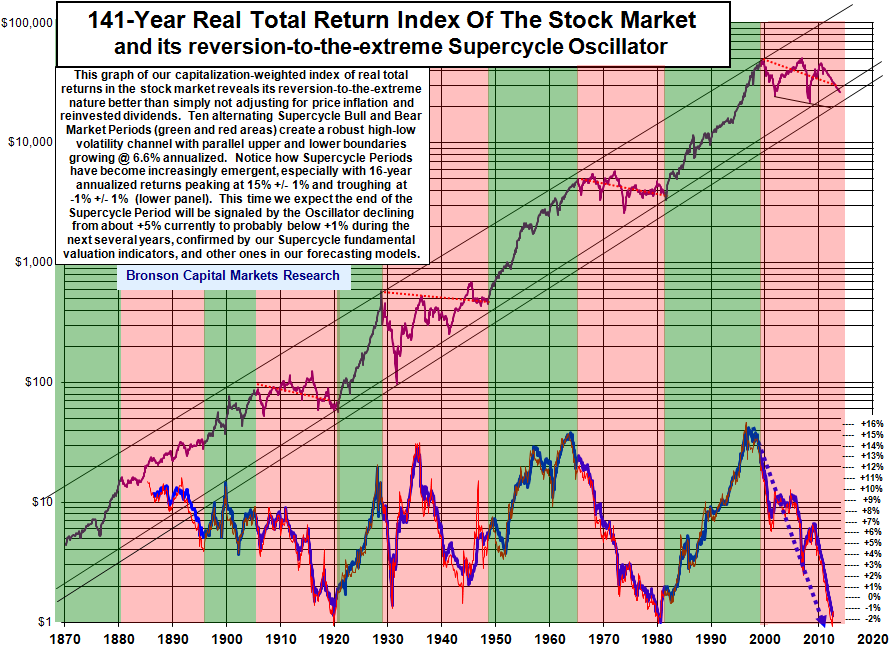

The following charts show that as long as a third and final Supercycle Bear Market is developing, as we’ve repeatedly forewarned, regardless of its actual path, or its price-time geometry, our Supercycle Oscillator (defined in the legends of the charts) will reach the mean-reversion target area that we’ve previously reported, which is sufficient to end the Supercycle Period Winter in about three years.

Furthermore, the same mean-reversion extreme is also true for all of our Supercycle Valuation Indicators. This includes these financial statement ratios from the aggregate income statement and balance sheet of all publicly traded U.S. corporations ): Price to Earnings, Price to Book Value, Tobin’s Q (price to enterprise value) and Price to GDP (supposedly Warren Buffet’s favorite macro valuation metric).

Upon request we will present updates of our charts for each of these.

Down-Up-Down Path (this one is what we broadly expect)

If the SPX declines during the next 11 months to 600, and is followed by a six-month 50% retracement rally, which is in turn followed by a 18-month flat period, along with inflation declining to 0%, then our 16-year Supercycle Oscillator will to continue to decline a mean-reversion low of -0.2% in Oct ’12, as illustrated in the chart below.

If the SPX low is 500 in Oct ’12 instead of 600 then the Oscillator low at that time will be -1.3%. If the SPX low is 700, then low will be 0.7%. If inflation does not decline, the Oscillator low will still be in Oct ’12, But it will lower at -0.7%.

Down-All-The-Way Path

If the SPX declines during the next 35 months to 600, without any meaningful interim retracement rally during the, along with inflation declining to 0%, then our 16-year Supercycle Oscillator will to continue to decline a mean-reversion low of -2.1% in Jul ’14, as illustrated in the chart below.

If the SPX low is 500 in Jul ’14 instead of 600 then the Oscillator low at that time will be -3.1%. If the SPX low is 700, then low will be -1.3%

If inflation does not decline, the Oscillator low will still be in Jul ’14, at the same -2.1%.

Source: Bronson Capital Markets Research